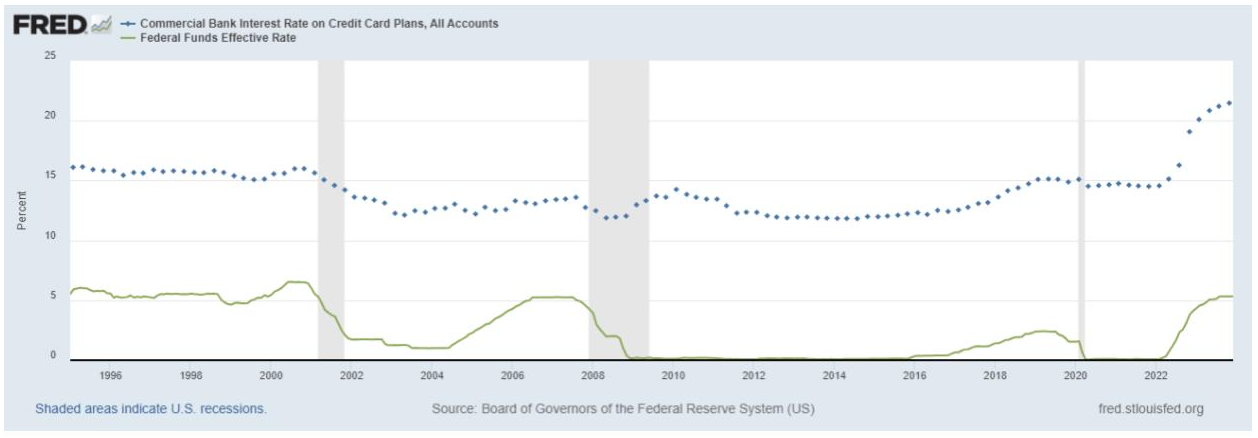

Credit card debt hit a record $1.08 Trillion by the third quarter of 2023, with an average balance of $5,900 per borrower. The interest rate for all credit card accounts hit a record 20.68% in May 2023, as reported by Federal Reserve data. This surge in rates is attributed to the Federal Reserve's efforts to control pandemic-era inflation by raising borrowing costs, which, in turn, has significantly impacted credit card rates. But historically credit card rates stayed high irrespective of low-interest rates as the last decade of credit card rates would suggest when the interest rates were near zero vs. the 1970s when inflation and interest rates were very high. The justification for such high-interest rates on credit cards by banks and issuers is that these are unsecured short-term loans and not for long-term borrowing.

The data above also shows the widening gap between Federal rates and the credit card interest rates during the last decade. A similar trend, among many others, is seen at the gas pumps where 93 Octane is priced at least $1 higher than the 87 Octane while historically the difference was not more than $0.20. At 20.68% of interest and $1.08T of the credit card balance, the annual interest payments stand at a whopping $223B, a large sum paid by poor and middle-class consumers, feeding the already large dividend pool contributed by the same businesses that reward well-to-do shareholders with more than 80% of the profit in the form of dividend and share repurchase.

Historically, these institutions have been scrutinized for charging exorbitant interest rates and fees, often targeting vulnerable consumers who lack financial literacy or alternative forms of borrowing.

It underscores the growing disparity between the cost of consumer borrowing and the rates available for other types of loans, like mortgages or student loans. This disparity highlights a systemic issue where credit card debt becomes a significant financial burden due to its high-interest rates, far outweighing other forms of consumer debt. This scenario perpetuates a cycle of debt, where consumers find it increasingly challenging to pay off their balances, leading to higher interest accrual and further financial strain.

While the article offers a snapshot of the current state of credit card interest rates, its implications are rooted in a broader historical context of banking and credit practices. The trend of increasing rates, especially in a post-pandemic economy, raises concerns about the ongoing challenges consumers face, particularly those with limited financial resources or knowledge, in managing credit card debt effectively. This situation, when viewed against the backdrop of historical practices, highlights the need for greater consumer protection and financial literacy to mitigate the impact of such high-cost borrowing.

Recently, a bill titled "Empowering States’ Rights to Protect Consumers Act" was introduced by Senator Sheldon Whitehouse and colleagues. This legislation aims to empower states to cap consumer loan interest rates and address the issue of high credit card debt. It seeks to restore states' ability to enforce interest rate limits on national bank lending within their jurisdictions, countering the effects of the 1978 Supreme Court decision in Marquette National Bank of Minneapolis v. First of Omaha Service Corporation. This bill is seen as a significant step towards protecting consumers from predatory lending practices and high-interest rates.

In other legislation news, the "Capping Credit Card Interest Rates Act," introduced by Senator Josh Hawley, aims to cap credit card interest rates at 18%, addressing the escalating credit card debt crisis and offering relief to Americans. This legislation not only proposes a cap on annual percentage rates but also seeks to prevent credit card companies from circumventing this cap through additional fees, thereby enforcing financial fairness.

This issue should get bi-partisan support and quick action to address this persistent financial woe for many consumers. Congress, policy makers and academia should better assess and understand the current lending practices for short-term borrowing such as credit card, payday loan and title max as well as internet based lenders who exploit vulnerable and low income consumer with aggressive marketing, questionable lending practices and use of collection services to intimidate borrowers under difficult situations. This is yet another systemic bias in our financial practices, rules and lack of rules that favor the rich against the poor and the dwindling middle class in our society.