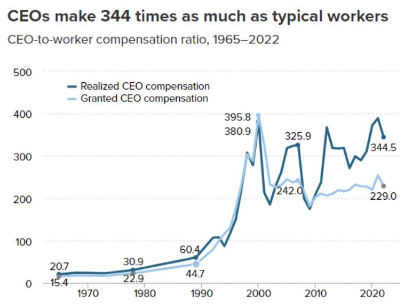

There is a widening chasm between executive pay for performance and average employee salaries. Reigning on excessive executive pay trend and fostering a more equitable economic landscape is an imperative that has become more acute since 1980s in USA and around the globe in recent years. Since 1978 CEO salaries soared more than 1,200%. In 2022, CEOs were paid 344 times as much as a typical worker in contrast to 1965 when they were paid 21 times as much as a typical worker. (1)

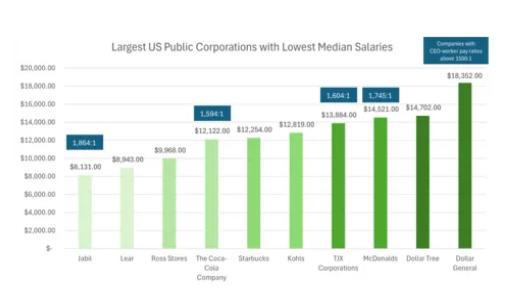

As shown from data captured by EPI, the surge in CEO pay over the decades shows the extent of greed that has captured our major corporations where CEO to Employee ratios is now higher than 1500:1 in some cases. While this seemingly unstoppable race to the top compensation for CEO in these corporations is being justified, there is a parallel race to the bottom when it comes to employee compensation, paying taxes to federal and states jurisdictions, producing quality products, investment in R&D and taking care of the environment.

These are the economic ideologies and corporate practices that have shaped such disparities since the 1970s. This growing inequality is not just a reflection of individual corporate decisions but also of broader economic policies and shifts in corporate governance and public policy. As an example of how changes in regulatory frameworks and economic policies have influenced corporate behavior, one can look at the current rampant practice of share buybacks and executive compensation. This shareholder primacy approach in corporate America, espoused during the era of Reaganomics, marked a pivotal shift in the landscape of American corporate and economic policy.

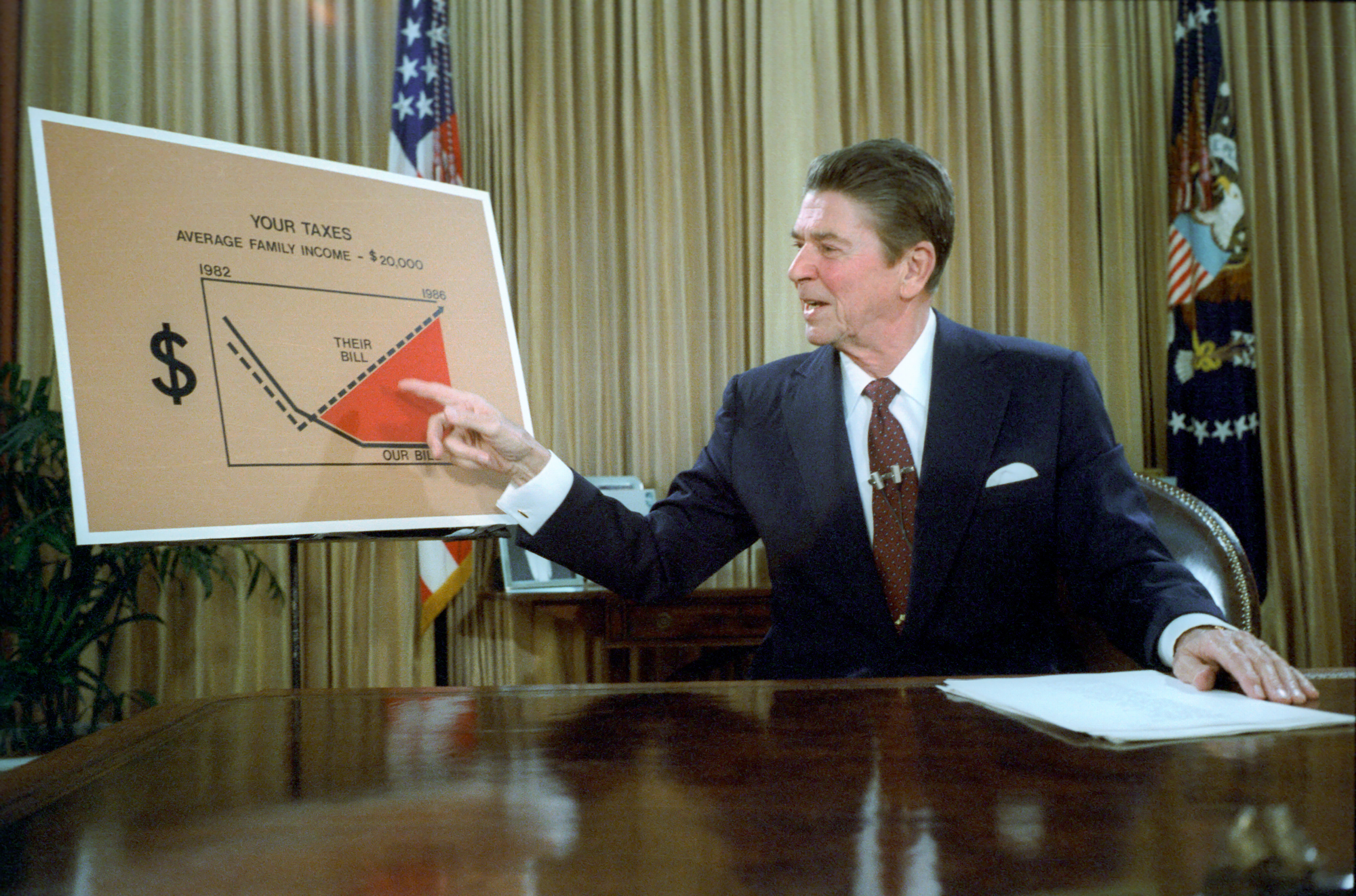

Reaganomics

The landscape of corporate America underwent a significant transformation from the post-World War II era through the late 1970s, characterized by a retain-and-reinvest approach. (2) This strategy emphasized retaining earnings and reinvesting them in the workforce and operational enhancements, fostering competitive advantages that led to equitable and stable economic growth, termed "sustainable prosperity." However, this approach shifted in the late 1970s towards a downsize-and-distribute model, prioritizing cost reductions and the redistribution of savings to shareholders, contributing to increased employment volatility and income inequality. This strategy was propagated by economists such as Milton Friedman and practiced by CEOs such as Jack Welch of GE. This drive for value extraction by a few in Wallstreet at the expense of value creation in Main Street become the de facto financial norm in American businesses.

This shift in corporate strategy was aided by changes in regulatory frameworks governing stock buybacks, particularly during the 1980s under Ronald Reagan's presidency. The appointment of John Shad as the head of the Securities and Exchange Commission (SEC) marked a turning point, leading to the adoption of rule 10b-18 in 1982. (3) This rule made it legal and provided a "safe harbor" for stock buybacks, allowing companies to avoid accusations of stock manipulation provided they adhered to certain parameters, such as not exceeding 25% of the stock’s average daily trading volume in a single day.

These regulatory changes catalyzed a significant shift in corporate financial practices, with profound implications for the economy. The SEC's orientation moved from regulating the stock market to promoting it, facilitating an environment where large corporations, like Apple, Microsoft, and Exxon Mobil, could spend billions on buybacks daily. This transition not only reflected a broader shift towards prioritizing financial stakeholders over the workforce but also underscored the complex interplay between corporate strategy, regulatory policies, and their long-term impacts on economic disparity and stability.

The practice of stock buybacks, increasingly prevalent in corporate America, has sparked significant debate and calls for a comprehensive reassessment. Critics argue that this financial strategy, while boosting earnings per share (EPS), does not enhance actual returns or engender fundamental value for companies or their shareholders. Such tactics, deeply rooted in the economic policies emblematic of Reaganomics, are seen as a retrogressive approach to corporate financial management. High-profile figures like Larry Fink, CEO of BlackRock, have publicly cautioned against corporate tendencies to “deliver immediate returns to shareholders, such as buy-backs," at the expense of "innovation, skilled workforces or essential capital expenditures necessary to sustain long-term growth.” (7) Similarly, President Biden has highlighted the adverse effects of rampant buybacks on business investment, noting the disproportionate impact on workers. The critique is further supported by data indicating that, from 2003 to 2012, stock repurchase and dividend amounted to 91% of net income among S&P 500 firms, as observed by William Lazonick of the University of Massachusetts. We believe that stock buybacks should be critically reevaluated and potentially reversed, to realign corporate strategies with long-term value creation and equitable shareholder benefits.

If it is Good for CEOs, it should be Good for Employees

The compensation structure for CEOs and executives markedly diverges from that of the general workforce, not only in magnitude but also in composition. Intriguingly, a mere 7% of a CEO's total remuneration typically consists of direct salary, with the lion's share—over 90%—stemming from performance-related incentives, including stock options, awards, and bonuses. (5) This model emphasizes a reward system that is heavily reliant on company performance and potential high earnings from stock market gains. By allowing executive compensation to be linked to EPS or stock prices, boards run the risk of promoting the short-term effects of buybacks instead of managing the long-term health of the company. (6)

Those who advocate (the board) this pay-for-performance scheme and increased equity compensation should also advocate for a similar performance scheme and increased equity for all employees within public companies. Every employee contributes to the success and growth of a company and, as such, should partake in the financial rewards stemming from such success. Implementing such a model could pave the way for a more equitable distribution of profits, aligning employees' rewards more closely with their contributions to the company's achievements.

We believe a broader application of performance-based compensation could represent a significant step towards democratizing earnings within the corporate structure, ensuring a fairer and more inclusive approach to remuneration. This strategy not only promises to bridge the gap between the top executives and the wider workforce but also fosters a culture of shared success and collective responsibility for the company's performance.

Endnotes:

2. Profits without Prosperity (2014)

3. Stock Buybacks, explained (2018)

4. Q3 2023 Stock Buyback Data: Trend Report (2024)

5. As CEO pay grows even bigger, so does its complexity (2022)