Private equity (PE) firms have evolved into central figures in the global financial ecosystem, wielding substantial influence across industries ranging from technology to healthcare. As we move into 2025, the narrative of private equity is shaped by both its achievements and challenges, with liquidity, innovation, and sustainable growth emerging as focal points. This article explores how leading firms like Blackstone, KKR, CVC Capital Partners, and The Carlyle Group are navigating these dynamics and examines the broader trends shaping the sector’s future.

Understanding Private Equity

At its core, private equity involves pooling capital from institutional investors—such as pension funds, sovereign wealth funds, and high-net-worth individuals—to acquire stakes in private companies or take public companies private. The goal is to optimize these investments through strategic management, operational improvements, and financial restructuring before exiting via sales, mergers, or IPOs.

The hallmark of private equity lies in its transformative impact. PE firms create value by unlocking efficiencies, driving innovation, and expanding market reach in their portfolio companies. However, this influence is not without controversy, as concerns around labor practices, excessive leverage, and transparency remain topics of public debate.

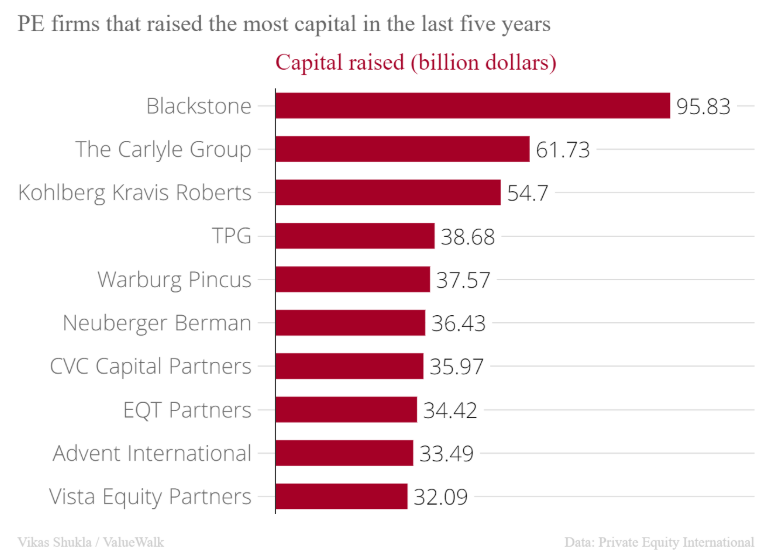

The Scale of Private Equity’s Influence

The top ten PE firms together control approximately $4.5 trillion in assets under management (AUM) and generate combined revenue of hundreds of billions of dollars, reflecting only a small portion of the total profits earned. The majority of private equity profits fall under earned income, a classification that allows for lower taxation compared to ordinary income—a tax burden that the vast majority of American wage earners are subjected to.

The Liquidity Imperative and Dry Powder

Private equity firms currently hold a record $3.9 trillion in dry powder, with $1.2 trillion allocated to buyout funds. At a staggering almost $4 trillion, this exceeds the U.S. discretionary budget and rivals the GDP of major economies like Germany and Japan. However, the aging nature of this capital—26% of which is over four years old—creates urgency for deployment. Rising interest rates and macroeconomic uncertainty have hindered dealmaking, but firms are exploring innovative solutions like continuation funds and NAV-based financing to navigate liquidity constraints.

The Wealth Divide and Economic Implications

While private equity creates substantial returns for institutional investors and high-net-worth individuals, it has also been criticized for exacerbating wealth inequality. PE’s focus on profit maximization sometimes results in significant job cuts, benefit reductions, and leveraged buyouts that prioritize short-term returns over long-term stability. Policymakers continue to scrutinize the role of PE in widening the wealth gap, particularly in sectors like retail and healthcare.

Performance Metrics and Transparency

One of the most debated aspects of private equity is its actual performance relative to public markets. Financial economist Ludovic Phalippou argues that after accounting for substantial fees, PE funds have delivered returns comparable to public equity indices since at least 2006. The reliance on the internal rate of return (IRR) as a performance metric has been criticized as potentially misleading, as it does not necessarily reflect the actual gains received by investors. This underscores the need for more transparent and standardized performance reporting within the PE sector.

Cross-Border Comparisons

The strategies and outcomes of private equity firms vary significantly across countries. For example, European firms like EQT embed sustainability and governance deeply into their operations, while U.S. firms such as Blackstone and KKR often prioritize scale and aggressive expansion. Asian markets, led by firms like Hillhouse Capital, focus on growth opportunities in emerging industries. These regional differences highlight how regulatory environments and cultural factors shape PE strategies.

What Happens When PE Firms Acquire a Company?

The acquisition process typically involves a leveraged buyout, where firms use borrowed capital to finance a significant portion of the purchase. Once acquired, companies undergo operational restructuring, cost optimization, and sometimes asset divestiture. While this approach can unlock efficiencies and drive growth, it often comes with challenges such as workforce reductions and heightened debt levels. Success stories like Dynatrace, transformed by Thoma Bravo, showcase the potential for long-term value creation, whereas failures like Toys “R” Us highlight the risks of excessive leverage.

Fee Structures and Wealth Distribution

A significant portion of PE profits is allocated to firm owners through performance fees, contributing to the creation of substantial personal wealth within the industry. Phalippou’s research indicates that between 2006 and 2015, performance fees alone amounted to $230 billion, leading to the emergence of numerous multibillionaires. This raises questions about the equitable distribution of profits and the broader societal implications of PE practices.

Industry Response and Ongoing Debate

The PE industry has contested Phalippou’s findings, citing studies that demonstrate outperformance relative to public markets and highlighting methodological differences in assessing returns. This ongoing debate highlights the complexity of accurately measuring PE performance and the importance of scrutinizing the metrics and assumptions used in such evaluations.

Sustainable Investing

ESG compliance will evolve from a strategic advantage to a baseline expectation, driving firms to adopt holistic sustainability frameworks. However, recent political administration changes have shifted the trajectory of sustainable investing. With Donald Trump signaling a rollback of ESG-focused regulations and policies, private equity firms may find themselves at a crossroads—balancing investor demand for responsible investing with a potential regulatory environment less favorable to mandated ESG disclosures. This shift could lead to a divergence in strategy, with some firms doubling down on sustainability as a long-term value driver while others pivot toward more traditional profit-driven approaches.

The Future of Private Equity: Transparency, Fairness, and Accountability

Private equity’s impact on the global economy is both profound and multifaceted. Firms like Blackstone, KKR, CVC, and Carlyle not only shape industries but also influence broader economic and societal trends. As the industry navigates the complexities of 2025 and beyond, its ability to adapt and innovate will determine its future trajectory. Whether addressing liquidity challenges, embracing ESG principles, or tackling controversies, private equity will remain a pivotal force in shaping the world of business and finance.

However, the industry must take steps to ensure greater transparency and accountability. Questions remain about the true value creation of PE firms—do they actually generate long-term value, or are profits derived primarily from financial engineering? More clarity is needed regarding how these firms contribute to sustainable economic growth and job creation.

Additionally, tax transparency and policy reform should be central to future discussions. The disparity between passive income taxation (such as capital gains and carried interest) and earned income taxation (such as wages from standard W-2 employment) has widened the wealth gap. Given that private equity earnings are often taxed at significantly lower rates, policymakers may need to reconsider how different types of income are classified and taxed to ensure a fairer system.

Ultimately, as private equity firms continue to amass wealth and influence, there is an ethical and economic imperative to explore ways in which prosperity can be more equitably shared across society.

References

- Bain & Company. (2024). Global Private Equity Report 2024.

- Blackstone. (2024). Q4 2023 Earnings Press Release.

- KKR. (2024). Annual Report 2023.

- CVC Capital Partners. (2024). Annual Review and Financial Results.

- The Carlyle Group. (2024). Q4 2023 Earnings Call Transcript.

- Securities and Exchange Commission. (2025). Compliance and Settlement Details.

- PitchBook. (2024). Private Equity Market Intelligence.

- Financial Times. (2024). PE Industry Trends.

- Reuters. (2024). Private Equity Market Analysis.

- Phalippou, L. (2020). Private Equity Laid Bare.