How Tariffs Shape Our World and the Aftermath of the “Fair and Reciprocal Plan”

The United States is reviving aggressive tariff policies that will reshape global supply chains and affect multiple US industries, including agriculture, production, manufacturing, technology, and more. For centuries, nations have wielded tariffs like powerful chess moves in global trade, protecting home industries and flexing geopolitical muscle. In 2025, the world is again navigating turbulent waters as the US implements tariffs for goods entering the country.

Tariffs are taxes imposed on imported goods, a deceptively simple albeit flawed idea for raising revenue. If a small US business imports $10 worth of products from China under a new 20% tariff, it must pay an additional $2 to the government, raising the product's total cost to $12. Companies then face a difficult choice: absorb this extra cost, cut profits, or pass it onto consumers through higher prices. Small businesses, often working on thin margins, frequently have little choice but to raise prices, potentially reducing their competitive edge against larger corporations.

Historical Context: From Protectionism to Globalization

Historically, countries have used tariffs that oscillate between protectionism and liberalization. The infamous Smoot-Hawley Tariff Act of 1930 in the US was intended to protect domestic industries during the Great Depression; instead, global retaliation deepened in the US, and world economic activity declined. Between 1929 and 1934, world economies shrank by approximately 66%

In response to such damaging trade wars, many nations sought an economic model emphasizing economic wealth through collaboration. The General Agreement on Tariffs and Trade (GATT) was established in 1947, following World War II. This agreement, the result of multiple negotiations, significantly reduced global tariffs. By the late 20th century, the establishment of the World Trade Organization (WTO) in 1995 further solidified international trade rules and mechanisms for dispute resolution, thus ushering in an era of unprecedented global trade expansion and economic interdependence.

Trade Balances: The Good, the Bad, and the Uncertain

A country’s trade balance - the difference between its exports and imports - is often used as a shorthand for economic health, but it tells only part of the story. A trade deficit may raise alarms about dependence on foreign goods or potential capital outflows, yet it can also signal strong consumer demand or high levels of domestic investment. On the flip side, a trade surplus might reflect a competitive export economy but could also indicate weak domestic consumption or underinvestment at home. Importantly, the trade balance is just one element of a country’s current account, which itself is part of the broader balance of payments—a full record of economic transactions with the rest of the world. Understanding trade balances in this wider context is crucial, as focusing too narrowly on deficits or surpluses can lead to misguided trade policies.

Economists are divided on the optimal global trade balance. Persistent deficits can boost consumer access and living standards but risk economic instability, while consistent surpluses may trigger political tensions as countries feel disadvantaged. In truth, no perfect balance exists; rather, stability is found in predictability and fairness, qualities that are increasingly elusive in today's global marketplace.

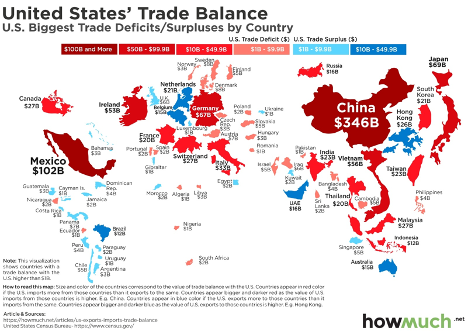

The U.S., a major importer, reported a $1.2 trillion trade deficit in 2024—signaling strong domestic demand and consumer spending. However, such a large deficit also raises concerns about long-term economic reliance on foreign goods and vulnerabilities in critical supply chains. In contrast, China continues to maintain a substantial trade surplus with the U.S., underscoring its dominant role in export-heavy industries like electronics and textiles.

Meanwhile, Mexico has become the U.S.’s largest trading partner, particularly in sectors like automotive manufacturing. This highlights the complexity of modern trade relationships: while trade deficits often imply economic imbalance, deep interdependence with partners like Mexico reflects a strategic integration of supply chains that can support economic resilience—so long as those relationships remain stable and mutually beneficial.

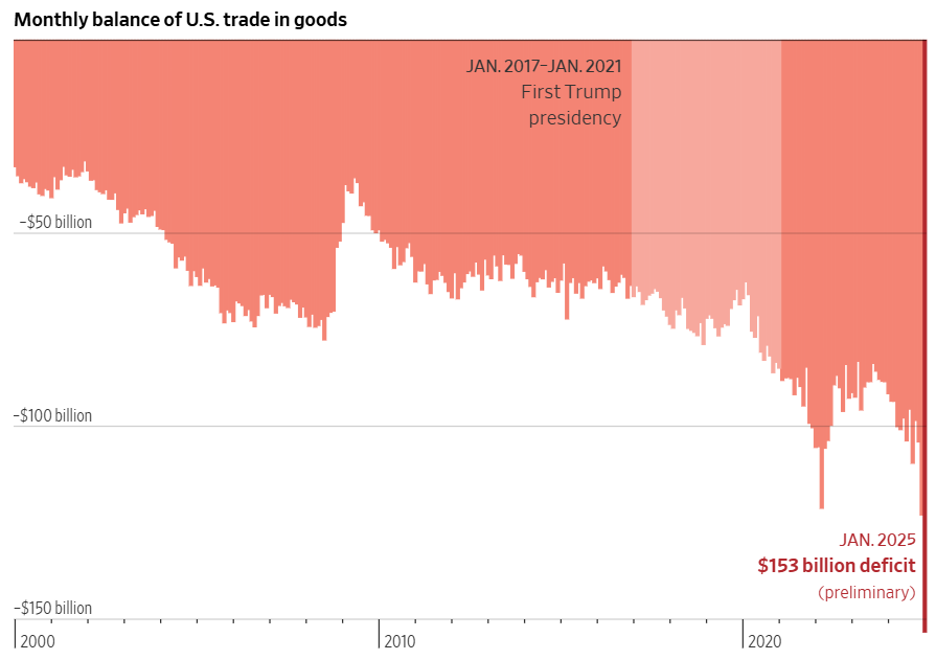

The Trump Factor: Renewed Tariff Turbulence in 2025

When President Trump returned to office in January 2025, he swiftly reinstated and expanded tariffs, reigniting trade tensions reminiscent of his first term (2017-2021). Trump quickly imposed a broad 20% tariff targeting Chinese goods, significantly escalating trade tensions with Beijing. An unprecedented 25% tariff will also be levied on imports from Canada and Mexico. The administration also reintroduced global steel and aluminum tariffs by 25%, reversing previous agreements with allies like the EU and Japan.

These sweeping measures immediately reverberated through key industries. US agriculture, already fragile from previous tariff battles, found itself once again targeted by Chinese retaliatory tariffs. Farmers exporting soybeans, pork, and beef saw demand plummet overnight. According to early industry estimates, US agriculture could face billions in lost revenue this year, potentially requiring another expensive taxpayer-funded bailout.

The automotive industry, dependent on Canadian and Mexican supply chains, faces higher costs as tariffs push prices of essential components upward. American automakers warn that this may lead to consumer price increases, job losses in assembly plants, and disruptions to decades-old production partnerships across North America.

Global Reactions: Allies, Rivals, and Economic Fallout

China swiftly retaliated against the US tariff with a similar tax against American agricultural products. China also signaled a willingness to endure a prolonged economic challenge. Meanwhile, Canada, outraged by tariffs it labels "unjustified," quickly imposed reciprocal 25% tariffs on American goods worth billions, directly impacting states reliant on exports such as machinery and processed foods.

Mexico has criticized the US on tariffs that will harm its regional economic stability. Mexico warned that prolonged disputes could permanently alter trade patterns. European allies, while not yet directly affected by new tariffs in 2025, are bracing for them as Trump has hinted at new levies on automotive imports, a sector vital to European exports.

The World Trade Organization faces renewed institutional pressures as member nations challenge US tariff actions. With WTO authority already weakened, many fear that continued unilateral tariff impositions may irreparably harm the global trade system, ushering in a fragmented landscape where countries increasingly turn inward or align into competing economic blocs.

Financial Times

The Broader Impact: Businesses and Consumers Feeling the Pressure

For US businesses, tariffs complicate supply chains, increase production costs, and pressure profit margins. Due to limited financial resilience, small and mid-sized businesses are especially vulnerable to tariffs and may be left making difficult operational decisions. American companies importing specialized electronics from China or automotive parts from Mexico face financial challenges of inflated costs. These would result in slimmer margins, or if the cost is passed to the consumer, it may reduce the competitiveness of their product.

Consumers, in turn, will encounter higher prices for everyday goods- electronics, appliances, and vehicles. A recent report by the Tax Foundation estimates that these tariffs could cost the average U.S. household more than $1,000 annually. During Trump’s first administration, when the US imposed tariffs on imported washers, prices for washing machines from all domestic and foreign brands increased by an average of 12%. A tariff on a swath of products will have higher costs and may contribute to inflationary pressures. This is something that the Federal Reserve does not want to happen to Americans.

Prolonged tariff wars create uncertainty for individuals employed in trade-sensitive industries. Workers in agriculture, manufacturing, and export-focused businesses will see their livelihoods affected by declining exports, rising costs, and market instability.

Looking Ahead: Stability or Escalation?

With tariffs becoming the US's preferred policy tool starting in 2025, the future of international trade growth is uncertain. Will countries continue escalating trade barriers, fragmenting the global supply chain? Will diplomatic and economic realities eventually force a strategic rollback toward cooperative trade?

In any direction the global trade winds blow, one thing remains clear: tariffs profoundly influence nations, industries, and individuals. Navigating this turbulent new landscape will require careful diplomacy, agile business strategies, and a global commitment to stability and fair competition.

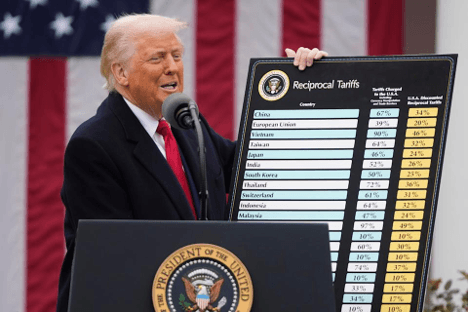

Aftermath of the “Fair and Reciprocal Plan”

Following the implementation of the “Fair and Reciprocal Plan” on April 2, 2025, the global economic landscape has experienced significant upheaval. The plan introduced a universal 10% tariff on all imports, with higher rates for specific countries based on perceived trade imbalances. This move has prompted swift and varied responses from U.S. trading partners, leading to escalating tensions and market volatility.

Global Responses and Retaliatory Measures

China responded promptly by imposing a 34% tariff on all U.S. goods, effective April 10, 2025, signaling a deepening of the trade conflict between the two nations. The European Union expressed strong opposition to the U.S. tariffs, labeling them as unjustified and warning of potential countermeasures to protect its economic interests. Japan also voiced its disapproval, with Trade Minister Yoji Muto describing the tariffs as “extremely regrettable” and indicating that Tokyo would consider its response in a "bold and speedy manner."

Other nations, including South Korea, Pakistan, Malaysia, and Indonesia, are exploring diplomatic avenues to address the tariffs, with some seeking direct negotiations with the U.S. to mitigate the impact on their economies. The widespread nature of these responses underscores the global ramifications of the U.S. tariff policy and the potential for a protracted period of economic uncertainty.

Market Volatility and Economic Concerns

The announcement and subsequent implementation of the tariffs have led to significant market volatility. Global stock markets have experienced sharp declines, with the S&P 500 entering bear territory and over $6 trillion wiped off U.S. stocks. Economists and financial analysts have raised concerns about the potential for increased inflation, disrupted supply chains, and a slowdown in global economic growth. Billionaire investor Bill Ackman warned of an “economic nuclear winter,” urging a 90-day pause on the tariffs to allow for negotiations and to prevent further economic instability.

Domestic and International Diplomatic Efforts

In response to the backlash, U.S. Commerce Secretary Howard Lutnick revealed that approximately 50 nations have reached out to negotiate the tariffs. Despite this international outreach, Lutnick confirmed that the tariffs would not be postponed, emphasizing the administration's commitment to addressing trade imbalances. This steadfast approach has further strained relations with key allies and trading partners, leading to a complex web of diplomatic negotiations and potential retaliatory measures.

Looking Ahead: Navigating an Uncertain Trade Environment

The implementation of the “Fair and Reciprocal Plan” marks a pivotal moment in international trade, with far-reaching implications for global economic stability. As nations grapple with the new tariff landscape, the potential for escalating trade wars looms large. Businesses and consumers alike face an uncertain future, with the prospect of higher prices and disrupted supply chains. The coming months will be critical in determining whether diplomatic efforts can de-escalate tensions or if the world is on the brink of a prolonged period of economic conflict.

References

- BBC News, “What are tariffs and why is Trump using them?” www.bbc.com/news/articles/cn93e12rypgo.

- WSJ, “The Countries Driving America’s $1.2 Trillion Trade Deficit in Goods”

www.wsj.com/economy/trade/us-trade-import-export-deficit-charts-490a7bce - MarketWatch, “China and Mexico ran the biggest trade deficits with the U.S. in 2024. What about Canada?”

www.marketwatch.com/ - Tax Foundation, “Impact of Tariffs on U.S. Households.”

TaxFoundation.org - World Trade Organization. “Understanding the WTO.”

WTO.org - U.S. Census Bureau. “U.S. International Trade Data.”

www.Census.gov - Understanding trade balances https://www.europarl.europa.eu/RegData/etudes/ATAG/2019/633187/EPRS_ATA(2019)633187_EN.pdf

- White House. Fact Sheet: President Donald J. Trump Announces “Fair and Reciprocal Plan” on Trade.

whitehouse.gov - Reuters. Trump tariffs draw global promises of counter-measures.

reuters.com - Associated Press. Asian nations seek negotiations as U.S. tariffs hit. apnews.com

- The Guardian. U.S. markets fall sharply following Trump tariff rollout.

theguardian.com - MarketWatch.Bill Ackman warns of 'economic nuclear winter,' urges 90-day timeout on tariffs.

marketwatch.com - New York Post. Commerce Secretary Lutnick confirms 50 nations negotiating over U.S. tariffs.

nypost.com