The Anticipation-Driven Recession Hypothesis

The COVID-19 pandemic was a global health crisis, but its economic impacts were profoundly shaped by anticipation, fear, and overreaction. Historically, recessions are triggered by fundamental economic downturns, but the COVID-19 recession highlighted a unique dynamic: corporate anticipation itself accelerated and magnified economic damage, creating a self-fulfilling prophecy. This comprehensive analysis delves deeply into governmental policy responses, corporate sector reactions, employment impacts, and financial market behaviors to reveal how anticipatory actions reshaped the trajectory and severity of the downturn.

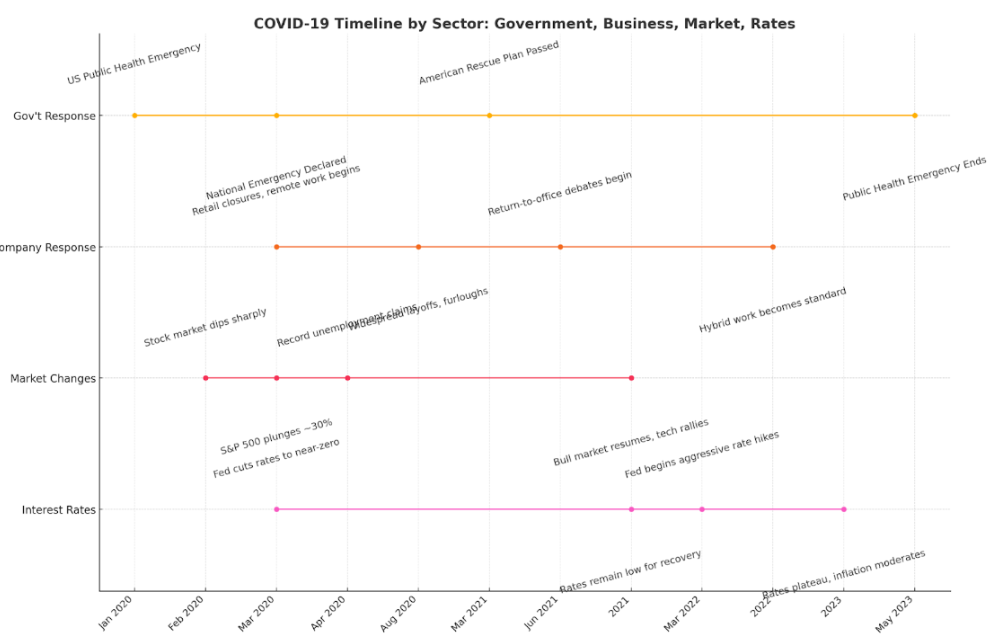

Government Policy and Chronological Timeline

Understanding the economic collapse requires a detailed timeline of governmental actions. Following the World Health Organization’s pandemic declaration in March 2020, swift policy measures ensued. The U.S. government enacted immediate lockdowns and announced substantial fiscal interventions, most notably the CARES Act ($2.2 trillion). This unprecedented stimulus sought to mitigate the immediate economic fallout by providing direct financial assistance to citizens, extended unemployment benefits, payroll protection loans, and small business grants.

These interventions conveyed significant uncertainty about the duration and depth of economic disruption. Consequently, many corporations, interpreting these government signals, began proactive austerity measures, including mass layoffs, wage freezes, and aggressive operational shifts, often preempting actual declines in revenue or operational necessity. Such measures intensified the immediate economic damage and contributed to prolonged uncertainty in the marketplace.

Sector-Specific Corporate Reactions and Strategic Shifts

The pandemic created divergent outcomes across various sectors, highlighting stark contrasts and deepening the recessionary impacts through anticipatory actions:

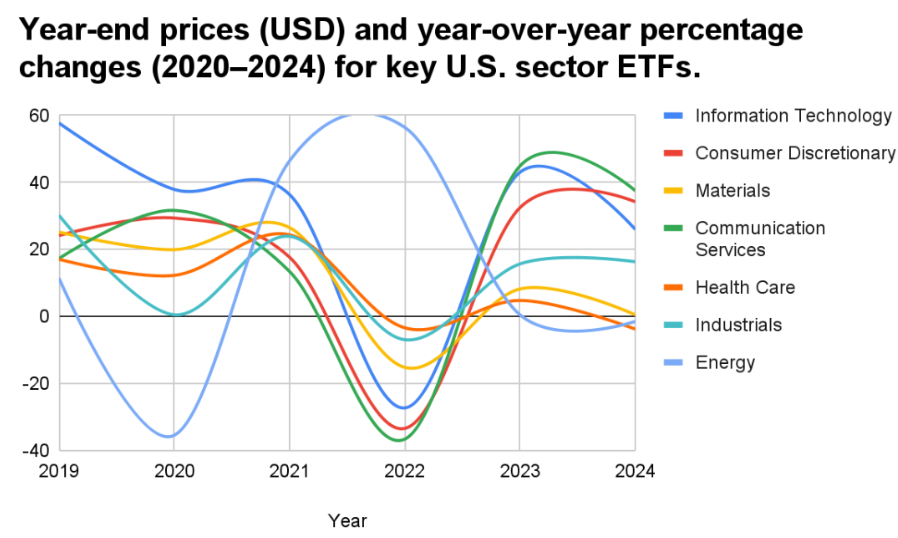

- Technology Sector: Benefited significantly from digital transformation, with companies like Zoom expanding their workforce by 120%, while leading cloud providers reported substantial quarterly revenue increases of 50-70%. NASDAQ surged 43% by mid-2020, demonstrating investor confidence in tech's resilience. However, despite strong earnings in subsequent years, major tech companies, including Amazon, Alphabet, and Microsoft, resorted to layoffs, driven by automation, AI-driven displacement, and cost-cutting strategies. Notably, Amazon’s operating income soared over 200% in Q1 2024, yet layoffs persisted, underscoring efficiency-focused strategies over workforce stability.

- Retail Sector: Experienced stark bifurcation. Online retail surged from $354 billion in 2019 to over $425 billion in 2020, surpassing $500 billion by 2022. Amazon added more than 400,000 workers to accommodate explosive growth. Conversely, traditional retail outlets, particularly apparel, saw dramatic job reductions due to massive sales declines exceeding 50%. Research from HBS highlighted industry variations, revealing digital-native firms like Wayfair thriving due to pandemic-driven e-commerce trends, whereas traditional brick-and-mortar companies, such as malls and quick-service restaurants, suffered severe downturns exacerbated by lower investments in employee-specific human capital.

- Travel and Hospitality: Suffered unparalleled damage, exacerbated by anticipatory layoffs and cost-cutting. Global air travel dropped by approximately 66% compared to 2019, resulting in major airlines cutting their workforce by 30,40% despite federal payroll support. Delta Air Lines exemplified strategic workforce management, using voluntary unpaid leave and early retirement programs to avoid forced layoffs initially. This approach allowed Delta to rapidly rehire employees as demand recovered, regaining pre-pandemic staffing levels by 2023.

- Real Estate Sector: Commercial real estate transactions declined sharply by 70,90% during peak pandemic quarters, reflecting profound market uncertainty. However, residential real estate thrived, buoyed by historically low mortgage rates and new consumer preferences for larger living spaces, driving a notable 10% increase in single-family home prices.

These anticipatory measures by corporations, though individually rational, collectively magnified the downturn, affecting employment stability and sectoral market dynamics.

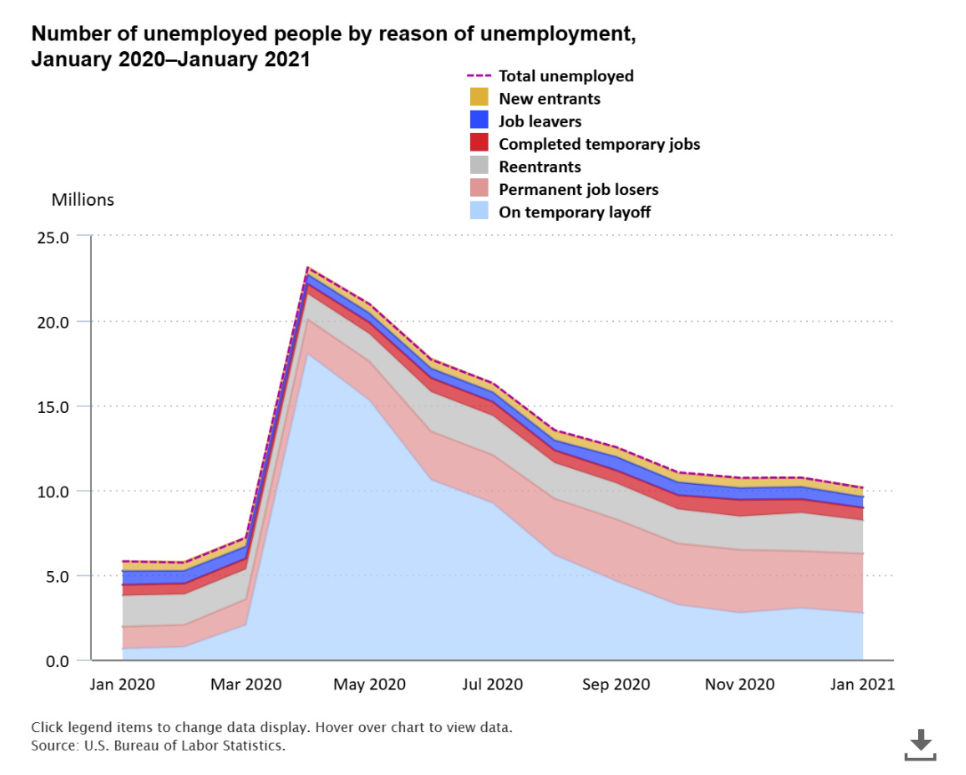

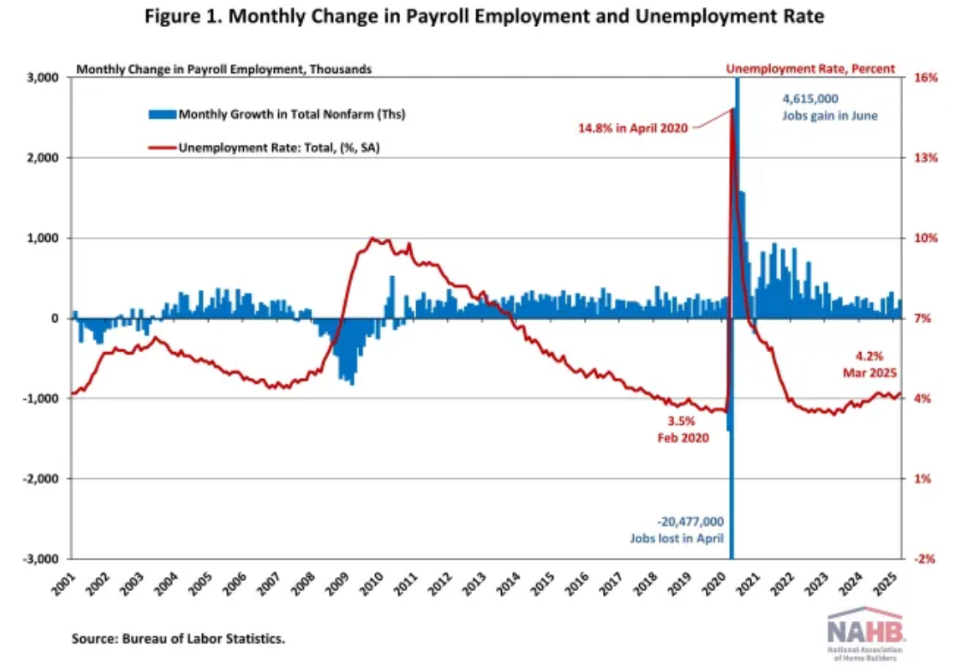

Labor Market Dynamics and Human Costs

The employment landscape during COVID-19 was unprecedented. In March and April 2020, the U.S. labor market hemorrhaged 22.4 million jobs,a drastic reversal of the longest employment expansion in U.S. history (113 months). Many layoffs were anticipatory, occurring before significant revenue declines or operational shutdowns.

Contrasting the U.S. approach, Germany's Kurzarbeit model demonstrated a viable alternative, government-backed subsidies enabling reduced working hours rather than layoffs. Germany maintained a lower unemployment rate (~4%) versus nearly 15% in the U.S., significantly stabilizing economic and social outcomes.

- Mental Health Crisis: Employment uncertainty heightened anxiety and depression, increasing global prevalence by 25% during 2020 alone. In the U.S., over 122 million people faced inadequate access to mental health care, exacerbating personal and societal strain.

- Gig Economy Surge: The gig economy expanded substantially, particularly in delivery services, growing by millions of participants between 2020 and 2021. While providing employment, this surge often offered less stability, fewer benefits, and greater income volatility.

- Remote Work Implications: Initially challenging productivity, remote work eventually provided positive benefits, including reduced turnover and higher job satisfaction. However, prolonged remote environments contributed to deteriorating employee engagement, with only 32% of employees feeling fully engaged by 2024,the lowest level in a decade.

These factors underscore the profound and lasting negative human consequences stemming directly from corporate anticipatory decisions during the pandemic.

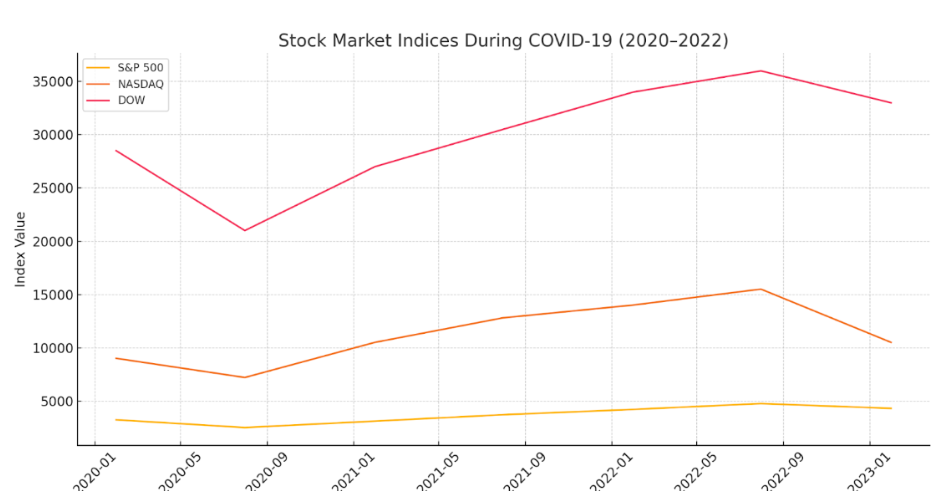

Stock Market Volatility, Investor Behavior, and Media Influence

Financial markets during the pandemic exhibited extreme volatility and investor anxiety. From February to March 2020, the S&P 500 plummeted 34%, the quickest such decline recorded, accompanied by record-high volatility indices (VIX). Concurrently, major financial media outlets amplified fears with stark, negative headlines, significantly influencing investor sentiment.

A rapid market recovery by mid-2020 highlighted a disconnect narrative between buoyant markets, especially in technology sectors, and persistent economic struggles on Main Street. Renewed concerns arose in 2022 due to surging inflation and aggressive interest rate hikes, leading to another downturn, notably a 33% fall in the NASDAQ index.

This media-driven amplification of recession fears created cyclical investor behaviors, where pessimistic reporting exacerbated cautious or defensive corporate actions, further deepening the economic impact, a textbook example of reflexivity, where perceptions became economic realities.

Lessons from Anticipatory Corporate Behaviors

The COVID-19 recession provides valuable insights into managing future economic disruptions:

- Speed versus Analytical Precision: Rapid corporate decisions must balance urgency with measured, data-driven analysis to avoid exacerbating downturns.

- System-Level Coordination: Coordinated, system-level responses can mitigate collective economic irrationality, as demonstrated by Germany’s Kurzarbeit program.

- Narrative Management: Proactively managing corporate messaging can mitigate the amplification of negative narratives and economic fear.

Investment in Long-Term Resilience: Companies maintaining flexibility and investing in employee relationships during crises recover more effectively, underscoring resilience as crucial beyond immediate efficiency gains.

Navigating Future Crises Through Improved Anticipation

The COVID-19 economic crisis vividly demonstrates how anticipatory behaviors significantly shape economic outcomes. While corporate decisions made during uncertainty were individually rational, their collective impact deepened economic hardship, forming a self-fulfilling recession. Recognizing this anticipatory dynamic is critical for businesses and policymakers to manage future crises effectively, ensuring more balanced and coordinated responses that support overall economic resilience.

References

- Ansell, Ryan, and John P. Mullins. "COVID-19 Ends Longest Employment Recovery and Expansion in CES History, Causing Unprecedented Job Losses in 2020." Monthly Labor Review, U.S. Bureau of Labor Statistics, June 2021. https://doi.org/10.21916/mlr.2021.13

- Centers for Disease Control and Prevention. "COVID-19 Timeline." CDC Museum. https://www.cdc.gov/museum/timeline/covid19.html

- Gallup. "The Post-Pandemic Workplace: The Experiment Continues." 2024. https://www.gallup.com/workplace/657629/post-pandemic-workplace-experiment-continues.aspx

- International Air Transport Association. "Air Passenger Monthly Analysis - December 2020." IATA Economics. 2020.

- International Monetary Fund. "Kurzarbeit: Germany's Short-Time Work Benefit." June 15, 2020. https://www.imf.org/en/News/Articles/2020/06/11/na061120-kurzarbeit-germanys-short-time-work-benefit

- McKinsey & Company. "COVID-19: Implications for Business." Risk and Resilience Practice. 2020.

- McKinsey & Company. "How COVID-19 Has Pushed Companies Over the Technology Tipping Point—and Transformed Business Forever." Strategy and Corporate Finance Practice. 2020.

- National Bureau of Economic Research. "The Evolving Role of Gig Work During the COVID-19 Pandemic." NBER Digest. August 2023.

- National Center for Health Statistics. "Mental Health Treatment Among Adults Aged 18–44: United States, 2019–2021." Data Brief No. 444. Centers for Disease Control and Prevention. September 2022.

- Statista. "Biggest Tech Layoffs Worldwide During COVID-19." 2023. https://www.statista.com/statistics/1127080/worldwide-tech-layoffs-covid-19-biggest/

- U.S. Bureau of Labor Statistics. "Remote Work, Productivity." Beyond the Numbers, Volume 13. 2024.

- USAFacts. "How Many People Are Laid Off Each Month?" 2025. https://usafacts.org/answers/how-many-people-are-laid-off-each-month/country/united-states/

- World Health Organization. "COVID-19 Pandemic Triggers 25% Increase in Prevalence of Anxiety and Depression Worldwide." March 2, 2022.