How Trump's signature legislation is reshaping the American dream for two very different families

On a sweltering July morning in suburban Atlanta, Sarah Johnson scrolled through her phone while sipping coffee in her home office. The successful corporate attorney had just finished reviewing her tax projections for the coming year, and the numbers were remarkable. Thanks to President Trump's One Big Beautiful Bill Act, signed with patriotic fanfare on July 4, 2025, her family stood to save nearly $85,000 in taxes this year alone¹.

Three hundred miles south, in a cramped Tampa apartment, Maria Rodriguez was having a very different morning. The single mother of two had just received a letter from the state Medicaid office. Her children's health coverage would end in six months. The same legislation that was delivering windfalls to families like the Johnsons was about to strip healthcare from 10.5 million Americans like the Rodriguez family by 2034².

These two women will never meet, yet their futures are bound together by the most ambitious wealth redistribution effort in modern U.S. history—one that flows sharply upward.

Turning Policy Into Profit

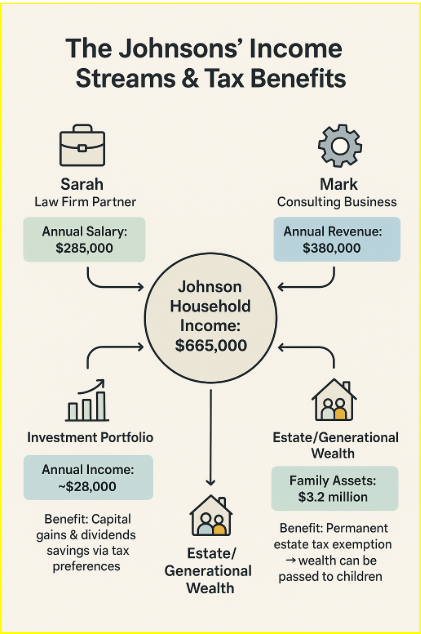

Sarah Johnson embodies the kind of high earner the bill was designed to reward. At 42, she earns $285,000 as a law firm partner, while her husband Mark adds $380,000 from his consulting firm—their combined income of $665,000 places them comfortably in the top one percent of American households³.

“We’ve always believed in hard work and building something of our own,” Sarah says, gesturing to family photos on the kitchen counter. “This legislation finally recognizes that.”

The Johnsons’ windfall comes from several sources. Mark’s clients—manufacturers investing in new technology—can now deduct the full cost of equipment and research immediately⁴, fueling more contracts and boosting his profits. That translates into more business for Mark and significantly higher profits.

“We’re not ultra-rich,” Sarah insists. “We’ve just worked hard, saved, and invested wisely. Now we can plan our kids’ future without worrying about the so-called death tax.”

The Johnsons’ portfolio also gains from lower taxes on capital gains and dividends, saving them about $28,000 a year. And with the bill’s permanent repeal of the estate tax, their $3.2 million in assets can pass directly to their children—preserving hundreds of thousands in future wealth.

The Johnsons plan to use their savings to expand Mark’s business, invest in real estate, fund elite college educations for their children, and perhaps buy a vacation home. For families like theirs, the legislation offers not only tax relief but also a blueprint for building generational wealth. The open question: who pays the price?

When Policy Fails the Vulnerable

Maria Rodriguez's story unfolds in an entirely different America. She is 34 years old and works two jobs to support her 8-year-old daughter, Sofia, and 12-year-old son, Carlos. She serves tables at a family restaurant during the day and cleans offices at night, earning about $31,000 annually between both positions⁵.

“I work seven days a week,” she says, folding laundry in her living room. “The kids sleep in the bedroom. I sleep on the couch. We make it work.”

Until now, government programs have made survival possible. Medicaid covered Carlos’s asthma medication and Sofia’s glasses. SNAP stretched their food budget. State-subsidized childcare allowed Maria to take night shifts. But the new law’s $1.02 trillion in Medicaid cuts over a decade will end coverage for families like hers.

“The letter says they’re ‘restructuring the program to promote efficiency,’” Maria says. “But efficiency for whom? Carlos needs his inhaler. Sofia needs to see the eye doctor. How is it efficient if my kids get sicker?”

Maria’s biggest financial strain comes from payroll taxes—which the legislation leaves untouched—and the rising cost of basic necessities that government programs had helped offset. Under the new rules, her SNAP benefits will drop from $340 to $180 a month, wiping out nearly two days’ worth of groceries. She had briefly hoped the bill’s elimination of taxes on tips might help, but the reality is stark: she already owes little in federal income tax. The support she’s losing is worth far more than any tax savings.

“They took away $160 in food stamps to save me maybe $20 in taxes,” she says bitterly. “That’s not a relief. That’s cruelty.”

Redrawing the Lines of Wealth

The One Big Beautiful Bill Act marks a turning point in American fiscal policy. Unlike past tax reforms, which at least claimed to offer broad-based benefits, this law openly trades social spending for tax cuts. The result is a direct transfer of resources from the nation’s most vulnerable families to its wealthiest.⁸

The Congressional Budget Office projects the bill will add $2.4 trillion to federal deficits over the next decade, driven largely by tax breaks for high-income households and business incentives. Most strikingly, it cuts $1 trillion from Medicaid to fund $1 trillion in tax breaks for families earning over $500,000 a year.¹⁰

Dr. Elena Chavez, an inequality scholar at the Urban Institute, calls it “the most regressive policy shift since the Gilded Age.” She explains: “If you’re wealthy, the government becomes a partner in building more wealth. If you’re poor, the government becomes an obstacle to basic survival.”

Supporters argue the law will spur growth. Representative James Morrison, one of its architects, insists: “When successful entrepreneurs like Mark Johnson can expand without tax penalties, they create jobs for workers like Maria Rodriguez. A rising tide lifts all boats.”

But early signs suggest the tide is selective. The bill’s permanent expensing provisions favor firms already profitable enough to make large investments¹¹. The expanded estate tax exemption applies only to the wealthiest three percent of families¹². Capital gains preferences primarily reward households with sizable financial portfolios¹³.

Meanwhile, the cuts fall on programs serving tens of millions of working families: Medicaid, which covers 72 million Americans, including 28 million children¹⁴. and SNAP, which supports 42 million people, most in households with children, seniors, or people with disabilities¹⁵.

The Regional Divide

The law’s impact varies sharply by geography, deepening existing political and economic divides. States with strong safety nets face the steepest cuts, while those with business-friendly tax structures reap the biggest rewards.

In Georgia, where Sarah Johnson lives, high earners will see substantial tax relief. However, the state is due anticipated to lose $12 billion in federal Medicaid funds over the next decade¹⁶. The state government now faces a painful dilemma: limited government, or caring for vulnerable citizens.

Florida, Maria Rodriguez’s home, faces an even harsher reality. Having refused Medicaid expansion under the Affordable Care Act, the state already left hundreds of thousands uninsured. Federal cuts will now strip coverage from another 380,000 Floridians. “Politicians say they’re pro-family,” Maria reflects. “But taking healthcare away from kids isn’t pro-family. It’s pro-rich-family.”¹⁷.

The Business Response

Corporate America has largely embraced the legislation. Provisions allowing immediate write-offs for capital investments have accelerated spending across technology, manufacturing, and pharmaceuticals.

Mark Johnson’s consulting firm illustrates this boom. Within six months of the bill’s passage, his contracts jumped from $1.8 million to $4.2 million. “Clients who had been holding back are suddenly moving forward,” he says. “It’s created a virtuous cycle where success builds on success.”

But that cycle looks different from Maria’s perspective. The very provisions fueling Mark’s growth siphon resources away from programs her family relies on to survive. Labor groups are pushing back: the Service Employees International Union has challenged the law in federal court, calling it “class warfare disguised as economic stimulus.”

The Healthcare Crisis and Education Divide

The $1.02 trillion in Medicaid cuts threaten basic healthcare for low-income families. For Maria, that means no inhaler for Carlos, no eye exams for Sofia, and fewer community health centers. Families like the Johnsons, meanwhile, can use their tax windfall to buy concierge-level care.

Education is following the same pattern. The Johnson children attend a $28,000-a-year private school, with savings left over for tutoring and enrichment programs. Maria’s children attend an underfunded public school already stretched thin. As state budgets contract under federal cuts, schools like theirs face larger classes, fewer programs, and crumbling facilities.

The gap widens further in higher education. The Johnsons’ children will enter elite private universities without financial strain. Maria’s children, who would normally qualify for aid, may find public universities more expensive as states hike tuition to cover lost revenue.

The legislation amplifies social and economic disparities, benefiting high-income families while leaving low-income families struggling with essential healthcare and education.

The Long-Term Trajectory

Economists warn the law will accelerate wealth concentration. Families like the Johnsons will see their resources multiply through tax breaks and business growth. Families like the Rodriguezes will fall further behind as safety nets vanish.

French economist Thomas Piketty calls it “a return to Belle Époque levels of inequality. When you privilege inheritance over merit and capital over labor, you make opportunity dependent on birth, not effort.” "When you systematically advantage capital over labor, investors over workers, inheritance over merit, you create a self-reinforcing cycle of inequality," Piketty explains. "The American dream becomes available only to those born into the right families."

The CBO projects that by 2034, the top one percent will have gained an average of $1.2 million, while households in the bottom 60 percent will lose about $23,000 in benefits and services.

The Political Reckoning

The One Big Beautiful Bill passed through budget reconciliation with no Democratic votes²³. Supporters hail it as “the most pro-growth, pro-family bill in American history.” Critics call it a betrayal that funds tax breaks for the wealthy by cutting essential programs for children and working families.

As public support for Medicaid and SNAP remains strong, political battles are shifting to the states, where leaders must decide whether to raise taxes to protect programs or allow them to wither.

Two Americas, One Future

As 2025 draws to a close, the contrast could not be sharper. The Johnsons are booking a European vacation with their tax savings. The Rodriguezes are calculating how to survive without healthcare.

These aren’t just different outcomes—they are different versions of America. In Sarah Johnson’s world, wealth is treated as a public good. In Maria Rodriguez’s, poverty is treated as a private failing.

The One Big Beautiful Bill Act makes its choice plain: individual wealth over collective welfare, private success over public service, separate prosperity over shared progress. Whether that choice strengthens or undermines American democracy will become clear in the years ahead, as families like the Johnsons and the Rodriguezes navigate increasingly different realities.

One result, however, is already certain. The law has succeeded in redistributing wealth and opportunity. The direction of that redistribution will shape American society for a generation—allowing some families to thrive as never before, while others struggle to survive in ways once thought impossible in the richest nation on earth.

Two families. Two Americas. One future—defined by whom we choose to reward, and whom we leave behind.

References

- Congressional Budget Office. (2025). Estimated fiscal impact of the One Big Beautiful Bill (H.R. 1). https://www.cbo.gov/publication/hr1-2025

- Center on Budget and Policy Priorities. (2025). Impact of H.R. 1 on low-income families and the federal budget. https://www.cbpp.org

- Internal Revenue Service. (2023). SOI Tax Stats -- Individual Income Tax Returns by Income and Demographics. https://www.irs.gov/statistics

- Tax Policy Center. (2024). Who pays taxes in America? An analysis by income level and race. https://www.taxpolicycenter.org

- Bureau of Labor Statistics. (2024). Occupational Employment and Wage Statistics: Food Service Workers. https://www.bls.gov/oes/

- Kaiser Family Foundation (KFF). (2025). Projected Medicaid & SNAP impacts under H.R. 1. https://www.kff.org

- Center on Budget and Policy Priorities. (2025). SNAP benefit calculations under revised utility allowances. https://www.cbpp.org

- Economic Policy Institute. (2024). CEO pay, corporate profits, and wage stagnation. https://www.epi.org/publication/ceo-pay-and-worker-wages-2024/

- Congressional Budget Office. (2025). Estimated fiscal impact of the One Big Beautiful Bill (H.R. 1). https://www.cbo.gov/publication/hr1-2025

- Picchi, A. (2025, May 16). How much would Americans of different income save in taxes if the GOP bill is signed into law? CBS News. https://www.cbsnews.com/news/gop-tax-bill-one-big-beautiful-bill-impact-by-income-group/

- Joint Committee on Taxation. (2025). Distributional effects of H.R. 1 tax provisions. https://www.jct.gov

- Tax Policy Center. (2024). Estate tax: Who pays and how much. https://www.taxpolicycenter.org

- Federal Reserve Board. (2022). Survey of Consumer Finances. https://www.federalreserve.gov/econres/scfindex.htm

- Centers for Medicare & Medicaid Services. (2024). Medicaid enrollment data. https://www.cms.gov

- U.S. Department of Agriculture. (2024). SNAP participation and demographics. https://www.fns.usda.gov/snap/

- Georgia Department of Community Health. (2025). Projected impacts of federal Medicaid funding changes. Internal analysis.

- Florida Agency for Health Care Administration. (2025). Medicaid program impacts under H.R. 1. https://ahca.myflorida.com

- National Association of Community Health Centers. (2025). Impact assessment: Federal healthcare funding reductions. https://www.nachc.org

- National Rural Health Association. (2025). Rural hospital closure projections under revised Medicaid funding. https://www.ruralhealthweb.org

- National Center for Education Statistics. (2024). Title I school demographics and performance. https://nces.ed.gov

- Brookings Institution. (2023). Racial wealth gap in America: Why it persists and what can be done. https://www.brookings.edu

- Congressional Budget Office. (2025). Long-term distributional effects of H.R. 1. https://www.cbo.gov

- Senate Budget Committee. (2025). Budget reconciliation procedures for H.R. 1. https://www.budget.senate.gov

- Pew Research Center. (2024). Public opinion on government spending and social programs. https://www.pewresearch.org