While crowds gathered near the National Mall, eyes lifted toward the sky in anticipation of the July 4th fireworks, something far more explosive was unfolding behind closed doors. As families waved flags and music echoed through the capital, inside the White House, the President quietly signed the “One Big Beautiful Bill” into law. No announcement. No fanfare. Just a signature that would ignite sweeping changes across the nation. The fireworks dazzled as planned—but few realized the real fireworks were yet to come.

The One Big Beautiful Bill, also referred to as H.R.1, was signed into law on Independence Day 2025 after being passed along extremely narrow party lines. Despite its overbearing title, the legislation's contents contain steep cuts to social services, corporate-favoring tax policies, and a redesigned immigration fee structure that many believe compromises equity and accessibility for those who are trying to become American citizens. A closer look at how this bill affects working families, students, and immigrants in America shows its flaws and its drawbacks.

The Price of "Hard Work": OBBB and Working Families

“Hard work always pays off, whatever you do.” - Dustin Lynch

That promise no longer holds for many American families.

Nearly 30% of full-time American workers make less than what is needed to maintain a moderate standard of living in their communities, according to the Economic Policy Institute (2025).

Consider a single mother in Virginia earning $17 an hour, which is well below the living wage needed to support a family with two children in her county, which exceeds $34 per hour (MIT Living Wage Calculator, 2025). Despite working full-time and managing childcare on her own, she relies on Medicaid and the expanded Child Tax Credit just to keep her family afloat.

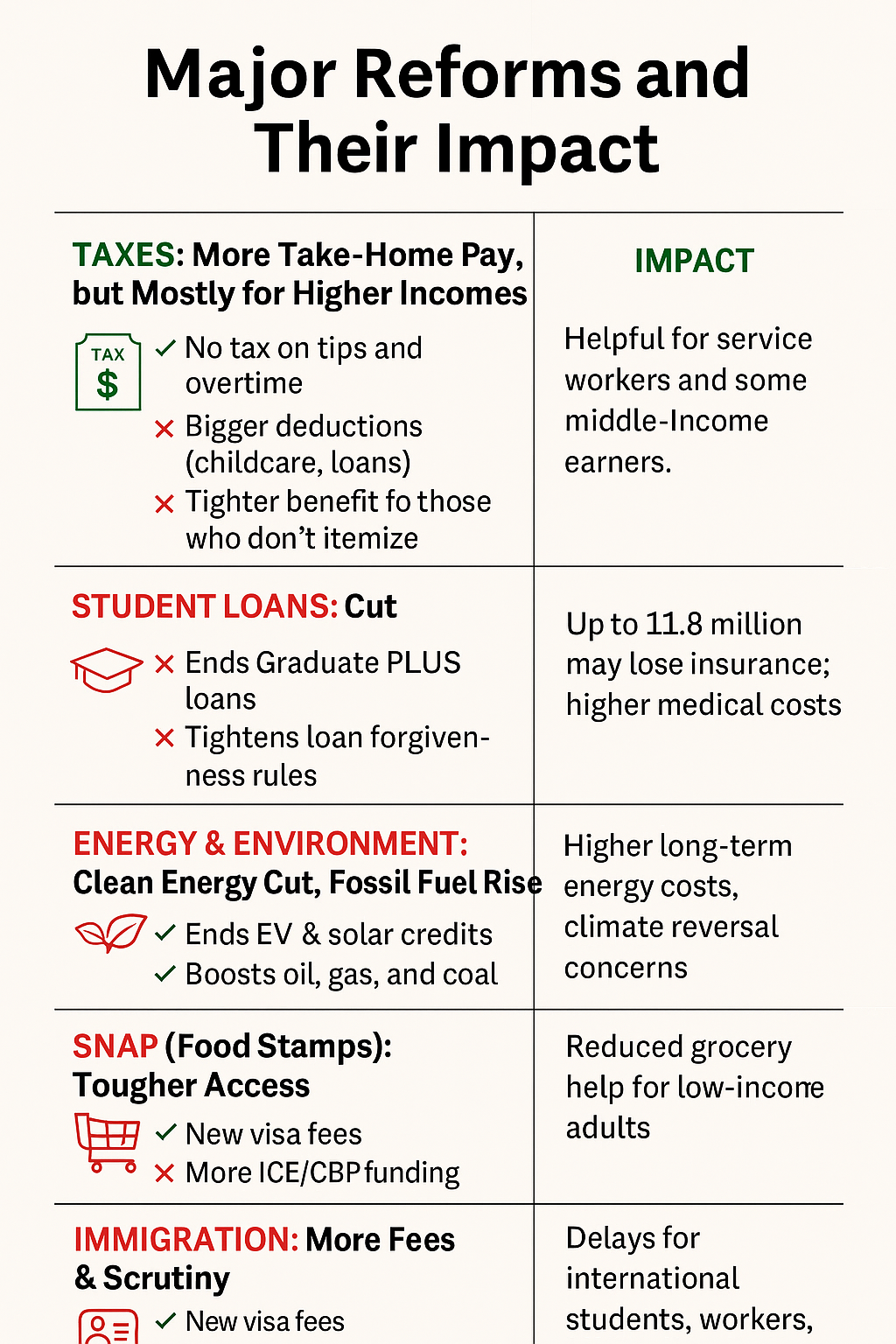

Under the OBBB, both lifelines will be drastically reduced. The bill tightens Medicaid eligibility and phases out expanded child benefits, disproportionately hurting low-wage earners like her. Without these supports, families like hers are forced into impossible choices: food or transportation, medicine or rent. Meanwhile, the bill delivers generous tax breaks to corporations, offering relief to those already thriving—while leaving behind those who are simply trying to survive.

Policy Changes for Student Debt

Wages and child benefits are just one aspect of the pressure on working families. Student loan debt is another significant financial burden for younger Americans, particularly those who are first-generation college graduates. Over 45 million student borrowers currently owe $1.7 trillion in federal debt, making student debt a defining economic burden for young Americans (Federal Reserve, 2025). The goal of upward mobility becomes increasingly unattainable for recent college graduates.

Think of a first-generation graduate who owes $38,000 in student loans. She juggles two part-time jobs, yet struggles to make minimum payments and keep up with rising rent costs. Her last financial safeguards are eliminated by OBBB, due to the bill discouraging future growth of income-driven repayment plans and phasing out student loan interest deductions. Instead of building a future, she’s stuck trying to stay afloat. The bill punishes ambition and burdens those who’ve worked hardest to change their circumstances, while offering little relief to those most in need.

Financial Barriers to Protection in Immigration

One of the main changes in immigration policy under OBBB is excessive fee-building that discourages those seeking legal status. Economic barriers to legal status are created by new regulations in Subtitle A that significantly raise the costs of applying for work permits, asylum, and renewals.

Miriam is a 24-year-old asylum seeker fleeing political violence. To legally work, she must pay $100 for her application, $550 for a work permit, and $275 for each renewal. For someone earning minimum wage, these fees are almost a month's salary, so protection in the US is only available to those who can afford it.

And Miriam is far from alone. According to the Migration Policy Institute (2025), an estimated 500,000 low-income immigration applicants will be impacted by OBBB each year. Many of them will be pushed into informal labor markets or legal limbo. By replacing legal principles with financial thresholds, the bill monetizes access to safety.

How It Got Passed: The Legislative Process

One Big Beautiful Bill, also known as H.R. 1, was introduced on May 20, 2025, and moved swiftly through Congress with little public comment. The House narrowly approved the amended bill after a more stringent Senate version passed on June 30. President Trump signed it into law as Public Law No. 119-21 on July 4.

The bill's party-line support is apparent in the final votes, where Republicans passed the bill with 51–50 in the Senate and 215–214 in the House, with Vice President J.D. Vance breaking the tie (Congressional Budget Office, 2025). Opponents contend that the bill's swift passage was the result of the reconciliation process, which allowed specific fiscal legislation to pass with a simple majority rather than the usual 60-vote threshold. The broad legislative scope of the bill, which bundled numerous other bills (consolidated tax reforms, immigration control funding, defense spending increases, and cuts to programs like Medicaid) created a high-stakes, all-in-one legislative package that enabled Republicans to approve the bill without any Democratic support, bypassing potential filibusters. The signing of the bill was orchestrated to exploit the patriotic symbolism of July 4th celebrations and thus obscured the more profound ramifications of its provisions.

Source : Congressional Budget Office. (2025). Estimated budgetary effects of H.R. 1 – One Big Beautiful Bill Act. Retrieved from https://www.cbo.gov

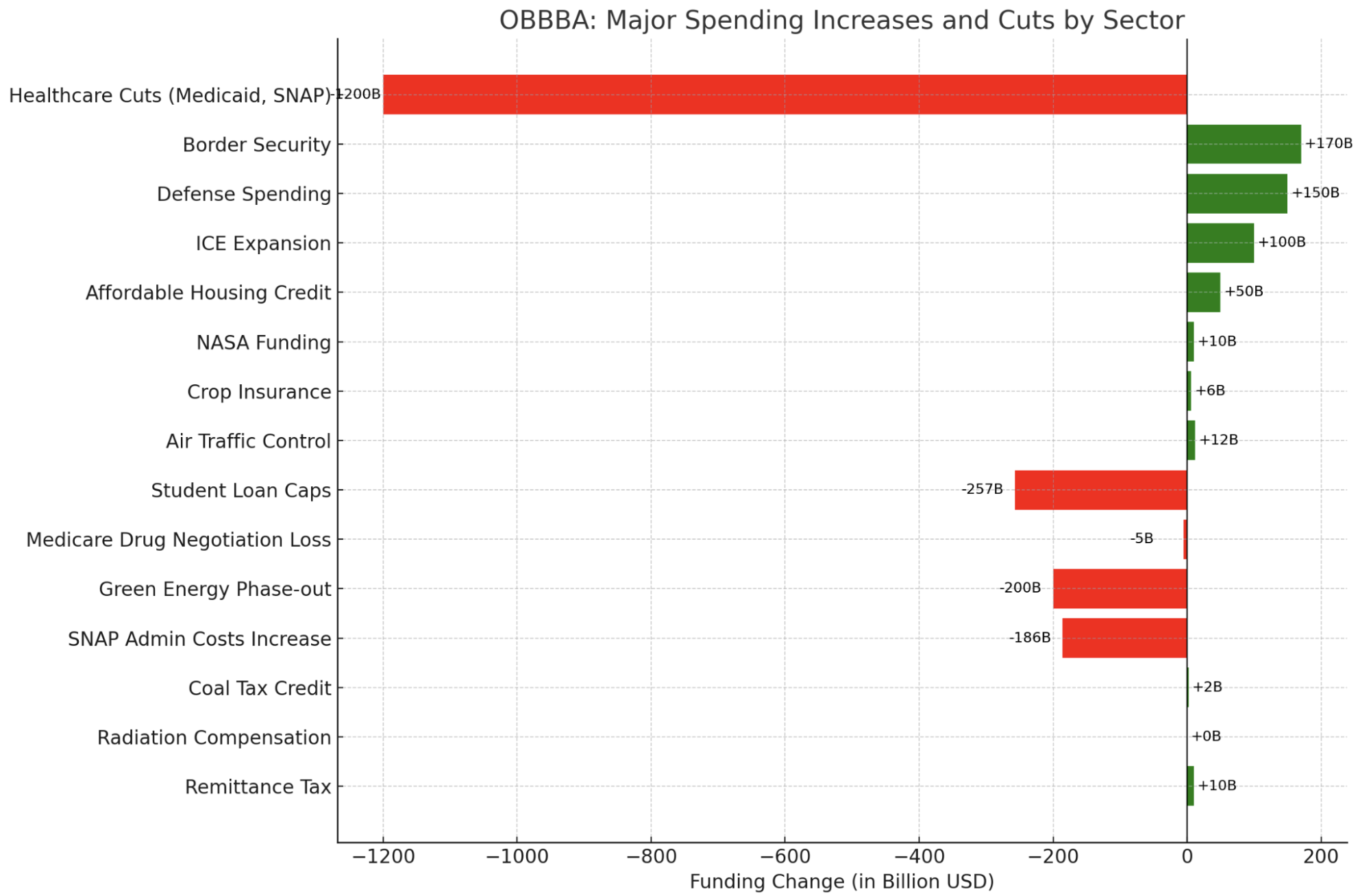

Key Points:

- Healthcare Cuts (–$1200B) are the most significant, affecting Medicaid and SNAP.

- ICE Expansion (+$100B) and Border Security (+$170B) reflect significant enforcement investments.

- Student Loan Caps and Green Energy Phase-out are shown as negative impacts.

Defense (+$150B), Housing (+$50B), and NASA (+$10B) are key spending areas.

Sources: Yale University Budget Lab. (2025). Combined effects of the House-passed OBBBA and tariffs on household incomes (2026–2034). Based on CBO estimates. Retrieved from https://budgetlab.yale.edu/research/combined-distributional-effects-one-big-beautiful-bill-act-and-tariffs

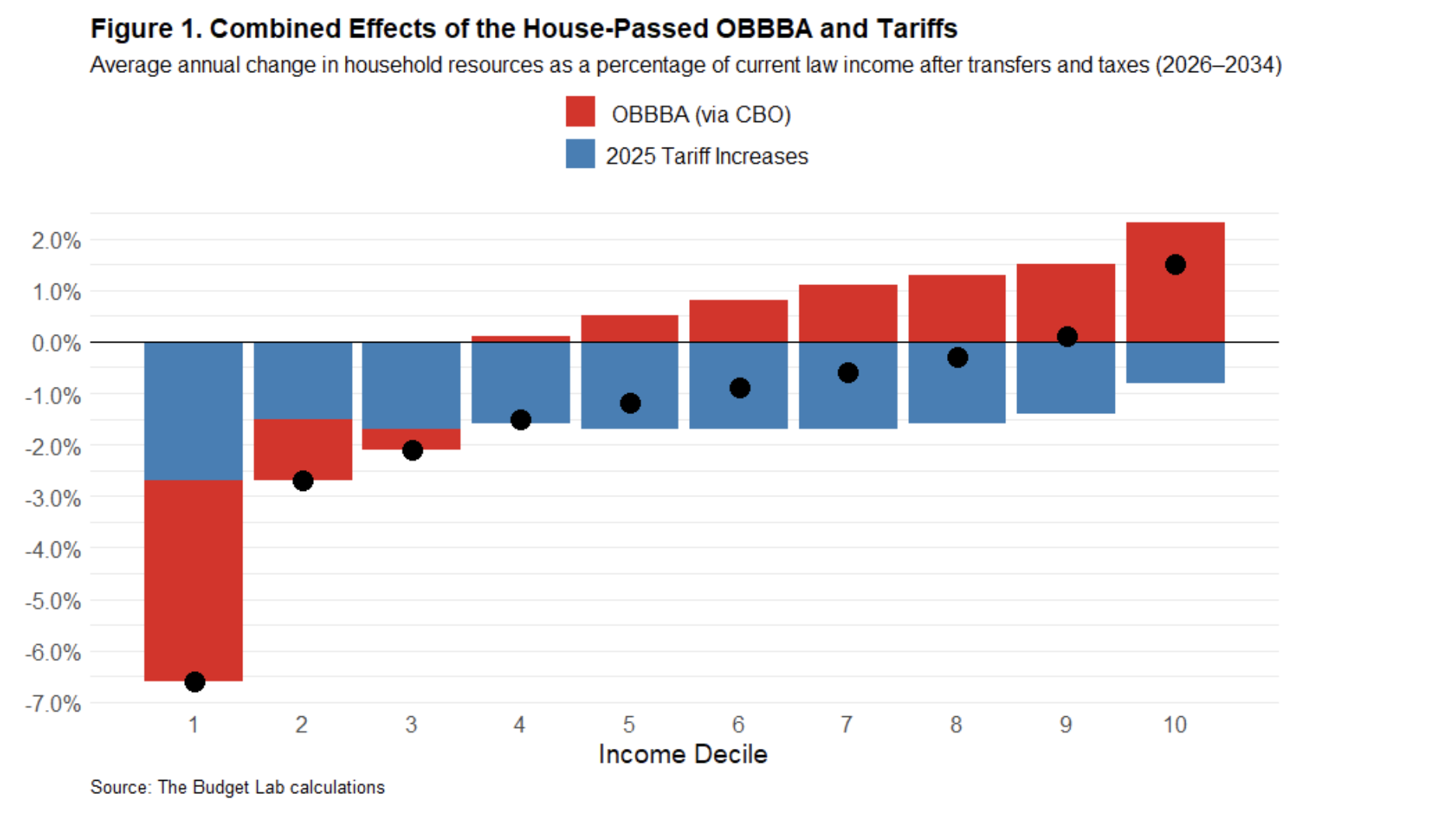

The combined effect of the 2025 tariff increases implemented as of June 1 and the One Big Beautiful Bill Act passed by the House of Representatives would reduce after-tax-and-transfer incomes on average to the bottom 80 percent of U.S. households.

Political Tensions

Politically diverse think tanks have expressed concern about the bill's potential long-term effects. According to the Congressional Budget Office, the legislation may increase the national debt by $5 trillion over the next ten years (CBO, 2025). As Medicaid cuts combine with clinic closures and a lack of staff, the Urban Institute issues a warning about a "public health cliff."

Children are particularly at risk. "The Senate's version of this bill... makes life substantially harder for low-income families and erodes decades of progress in children's health coverage," writes Joan Alker of Georgetown's Center for Children and Families (Georgetown CCF, 2025).

With no Democrats voting in favor and Republicans using budget reconciliation to get around Senate filibuster rules, the passage of H.R. 1 demonstrated the growing political polarization in America (CBO, 2025). To advance tax relief and social program reform, GOP leaders presented the bill as a return to economic freedom and fiscal restraint. Democrats, on the other hand, strongly criticized the bill's significant Medicaid and SNAP cuts, arguing that they would worsen inequality and leave underprivileged communities behind (Urban Institute, 2025; KFF, 2025).

Regional Repercussions: Effects All around the United States

Supporters of the bill claim it reduces dependency and incentivizes hard work. Yet its structure disproportionately benefits wealthy individuals and Republican-led states that have historically resisted expanding federal safety nets. States like Florida and Texas—neither of which adopted Medicaid expansion—stand to gain from generous business tax breaks and retiree exemptions. In contrast, blue states with more comprehensive welfare programs absorb the brunt of fiscal shocks, facing reduced federal support and tighter constraints on funding mechanisms like provider taxes. The result is a policy that deepens regional inequities and penalizes states that invested in inclusive social infrastructure. (Urban Institute, 2025; KFF, 2025).

In the meantime, disadvantaged communities suffer the most. Black and Latino households are more likely to be negatively impacted by the bill's cuts because they are overrepresented in programs like Medicaid and SNAP (Census Bureau, 2025). Despite contributing through taxes and working in vital industries, such as healthcare, construction, and agriculture, undocumented families are completely denied tax credits, further entrenching economic vulnerability among those already marginalized.

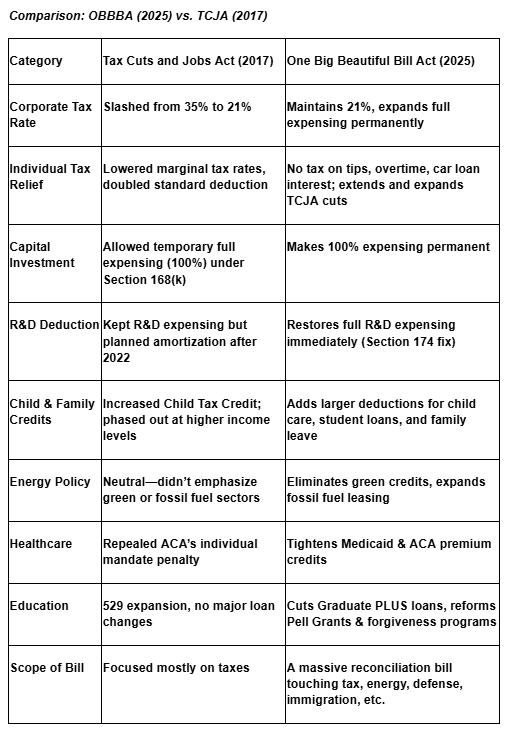

BBB vs. Past Bills

The One Big Beautiful Bill eliminates vast amounts of public investment, marking a sharp departure from its predecessor, the 2017 Tax Cuts and Jobs Act (TCJA), which temporarily boosted wages and consumer spending through broad-based tax relief and incentives for business investment. Under the new law, deductions for overtime and tip income are capped at $12,500 and $25,000 respectively, and phased out for higher earners. Public colleges face new tiered endowment taxes, a provision that previously applied only to private institutions. Meanwhile, clean energy incentives from the Inflation Reduction Act—including credits for wind, solar, and electric vehicles—are either eliminated or severely curtailed.

Instead of investing in social infrastructure, the bill redirects billions toward border infrastructure and defense spending. It allocates over $170 billion for immigration enforcement and border security and another $156 billion for military modernization. The shift reflects a broader reordering of national priorities: away from public welfare and toward militarized control.

Conclusion

With measures like expanded business spending, higher defense spending, and R&D tax incentives, OBBB may provide short-term economic stimulus, but at a steep cost of year-on-year increased budget deficits putting the entire economy under distress. The bill creates immigration barriers that disproportionately impact vulnerable communities, cuts assistance for low-income families, and restricts healthcare and educational benefits. These modifications run the risk of worsening public health outcomes, increasing income inequality, and delaying the advancement of climate resilience over time.

Beyond its essence, questions concerning the democratic process and public oversight are raised by the bill's hurried passage through narrow votes and reconciliation procedures. Its effects are very real as they are already changing the lives of many Americans.

The bill represents a moral as well as a financial turnabout, as it represents a change in national priorities. It changes the narrative of who needs assistance and who is left on their own. The story is being told in real time for low-income and immigrant families. Yes, it is a tale of perseverance, but it also depicts hardship brought on by policy. Perhaps the One Big Beautiful Bill will be remembered as a turning point in economic history. Who gets to write the next chapter will determine whether it is viewed as a step forward or a betrayal.

References:

American Journal of Medicine. (2023). The political battle over the Affordable Care Act: A decade of division.

Budget Lab. (2025, July 17). Combined distributional effects of the One Big Beautiful Bill Act and tariffs. Yale University. https://budgetlab.yale.edu/research/combined-distributional-effects-one-big-beautiful-bill-act-and-tariffs

Center for Children and Families. (2025, June 24). Things just got worse for children and families in the Senate version of OBBB. Georgetown University Health Policy Institute. https://ccf.georgetown.edu/2025/06/24/things-just-got-worse-for-children-and-families-in-the-senate-version-of-obbb/

Center on Budget and Policy Priorities (CBPP). (2025). Analysis of OBBBA’s Medicaid, SNAP, and Student Loan Provisions.https://www.cbpp.org/research/obbba-safety-net-impact

Citizens.org. (2025). Climate risk is financial risk. https://www.citizen.org

Congressional Budget Office. (2025). Cost estimate for H.R. 1, the One Big Beautiful Bill. https://www.cbo.gov/publication/one-big-beautiful-bill

Congressional Budget Office. (2025). Estimated fiscal impact of H.R. 1.

Economic Policy Institute. (2025). Economic Policy Institute [Nonprofit think tank]. Washington, DC: Author. Retrieved from https://www.epi.org

Government of Canada. (2024). Canada child benefit statistics. https://www.canada.ca

Kaiser Family Foundation. (2025). Medicaid and ACA enrollment by state. https://www.kff.org

Kaiser Family Foundation. (2025). Projected Medicaid & SNAP impacts under H.R. 1.

Living Wage Calculator. (2024). Living wage calculation for the United States. Massachusetts Institute of Technology. https://livingwage.mit.edu/

Rural Health Policy Institute. (2025). Rural hospital vulnerability index. https://www.ruralhealthinstitute.org

Tax Foundation. (2025). Analysis of the One Big Beautiful Bill (H.R. 1). https://taxfoundation.org

Tax Foundation. (2025). Business incentives and regional growth effects. https://www.taxfoundation.org

Urban Institute. (2025). Distributional effects of estate and retirement tax changes. https://www.urban.org

U.S. Congress. (2025). H.R. 1 – One Big Beautiful Bill Act of 2025. 119th Congress. Congress.gov. https://www.congress.gov/bill/119th-congress/house-bill/1/text

U.S. Department of the Treasury. (2017). Analysis of the Tax Cuts and Jobs Act. https://home.treasury.gov/news/press-releases/sm0256

U.S. House of Representatives – H.R. 1 Full Text. (2025). Retrieved from https://www.congress.gov/bill/119th-congress/house-bill/1/text

White House. (2025, July 4). President Trump signs H.R. 1 into law. https://www.whitehouse.gov