A Living Wages Series: Part Two

The living wage discourse often casts a wide net, exploring economic impacts across industries. However, within this series, we now turn our focus to a single industry—retail. Retail is unique, as it employs a substantial share of minimum-wage workers and faces some of the most significant challenges in wage disparity. We will examine how wages, benefits, and corporate policies shape the retail workforce’s economic reality, with a deeper look at the contrast between part-time and full-time positions and case studies on giants like Walmart and Costco. In understanding the wage structure within retail, we can better grasp the sector’s role in advancing (or hindering) equitable wage practices.

Source: ZipRecruiter (2024), MIT Living Wage Calculator

Retail Worker Wages: An Overview

Retail workers' wages in the United States span a broad range, with positions from cashiers and stock clerks to supervisors experiencing notable income disparities. As of September 2024, the median hourly pay for retail workers is $17.15, with variations across states and roles (ZipRecruiter, 2024). Retail workers at the 25th percentile earn around $14.42 per hour, while those at the 75th percentile earn $18.75, showing how few attain wages close to or above local living wage thresholds.

In high-cost regions, such as Santa Monica, CA, where retail workers average around $18 hourly, earnings may seem higher. However, the cost of living hovers at above $27 per hour and these wages remain prohibitive for many, underscoring the financial precariousness of retail employment, especially when measured against living wage standards (MIT Living Wage Calculator, 2024). This gap between wages and cost of living forms the core of the wage struggle within the retail sector.

Source: Economic Policy Institute (2024)

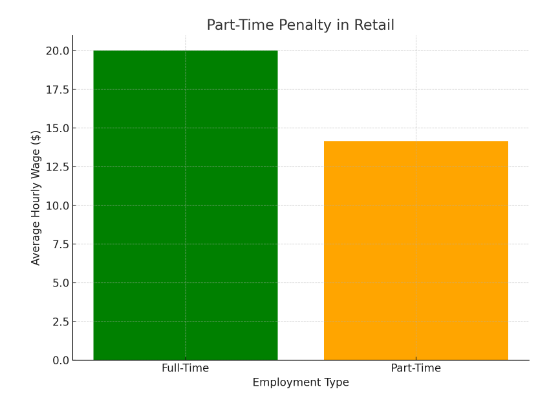

Comparing Wages and Benefits: Full-Time vs. Part-Time Workers

The difference between part-time and full-time employment in retail extends beyond the number of hours worked. According to the Economic Policy Institute, part-time retail workers face a significant wage penalty, earning approximately 29.3% less per hour than their full-time counterparts, a gap that persists even when accounting for occupation and qualifications (EPI, 2024). Additionally, part-time retail workers—who are disproportionately women—often experience reduced access to essential benefits like healthcare, paid time off, and retirement plans, which limits their financial security and career advancement potential.

In companies like Walmart, part-time workers face barriers to benefits access. They must work an average of 30 hours weekly for 60 days to qualify for benefits, while full-time workers gain eligibility immediately. This benefits disparity highlights the structural challenges within retail that prevent part-time workers from achieving economic stability (Walmart Benefits Guide, 2024). Given that part-time roles make up a considerable portion of the retail workforce, especially among women and minority groups, these wage and benefit gaps exacerbate existing economic inequities.

Source: Comparably (2024), Glassdoor (2024)

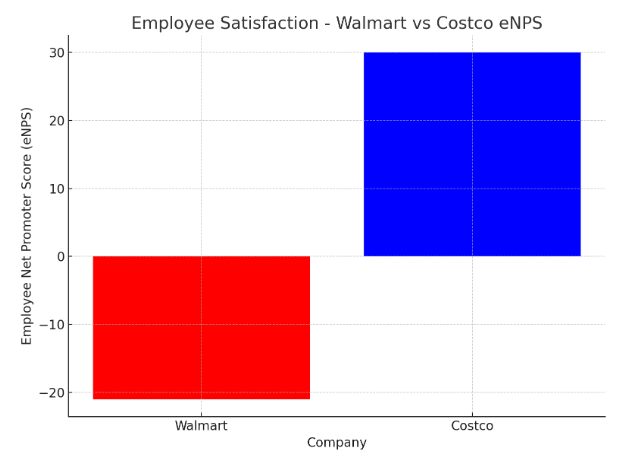

Wage Satisfaction and Employee Retention: Walmart vs. Costco Case Study

Employee satisfaction with pay is a critical indicator of workforce stability, and comparing companies like Walmart and Costco reveals how compensation strategies can impact turnover and morale. Walmart’s entry-level wage has increased modestly, starting at $15 per hour in most locations, but employees report high levels of dissatisfaction. In a recent survey, 48% of Walmart employees felt underpaid, and 70% indicated they would leave for a 20% pay increase, contributing to a negative Employee Net Promoter Score (eNPS) of -21 (Comparably, 2024).

In contrast, Costco has adopted a more competitive wage structure, paying entry-level workers around $18.50 per hour. Costco’s approach to wages and benefits has resulted in an eNPS of +30, reflecting higher levels of employee loyalty and satisfaction. The stark difference in retention rates and employee morale between these companies underscores the value of competitive compensation in fostering a stable and engaged workforce (Glassdoor, 2024). Costco’s strategy demonstrates that fair wages can drive better outcomes for employees and, ultimately, for company performance.

Source: Mergent Online (2024)

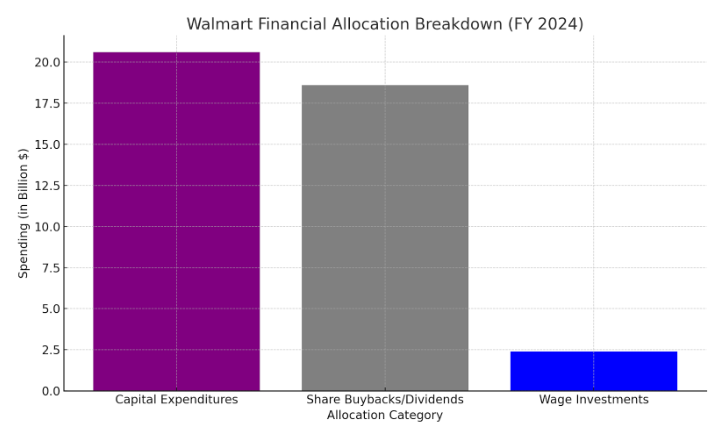

Financial Performance and Wage Allocation in Retail Giants

Despite wage stagnation for many retail workers, financial data indicates that leading companies in the sector, such as Walmart and Costco, have seen substantial growth in operating cash flow. Walmart, for instance, recorded a 23.87% year-over-year increase in operating cash flow from FY 2023 to FY 2024. Yet, much of this financial growth has been allocated toward capital expenditures and shareholder returns rather than employee wages. Walmart’s capital expenditures on technology and infrastructure improvements reached $20.6 billion in FY 2024, and the company spent approximately $18.6 billion on stock buybacks and dividends, a strategy that ultimately prioritizes investor returns over meaningful wage increases (Mergent Online, 2024).

The focus on returns to shareholders contrasts with the approach taken by Costco, which has increased both employee wages and shareholder payouts in tandem. By balancing shareholder interests with employee needs, Costco showcases a sustainable model that aligns corporate profitability with workforce investment. For retail giants, the allocation of financial gains remains a decisive factor in shaping both employee welfare and long-term business outcomes.

Source: Economic Policy Institute (2024)

Historically, poverty among minority and impacted groups in the U.S. has deep roots tied to systemic inequality, restricted access to quality education, and limited economic opportunities. For many marginalized communities, including Black, Hispanic, and Indigenous populations, the legacy of discriminatory practices—such as redlining, exclusion from certain jobs, and unequal access to financial resources—has perpetuated economic disadvantages across generations. In the retail sector, these groups often fill roles that are low-paying, part-time, and lacking benefits, which can create a cycle of poverty. This economic reality, compounded by the cost of living outpacing wages, has left many retail workers in these demographics struggling to achieve financial stability. The persistence of these disparities underscores the importance of policies aimed at equitable wage practices within the industry.

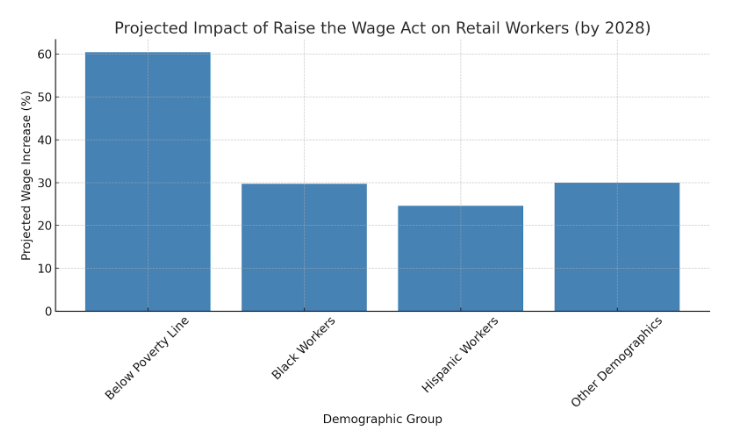

Legislative Landscape: Policies and the Future of Retail Wages

To address these disparities, proposed policies like the Raise the Wage Act of 2023 and the Part-Time Worker Bill of Rights Act could have significant impacts on the retail sector. The Raise the Wage Act, for example, proposes a gradual increase in the federal minimum wage to $17 by 2028, potentially lifting over 60% of workers currently below the poverty line, especially benefiting Black and Hispanic employees who are overrepresented in low-wage roles. This wage increase could inject an estimated $86 billion into the economy by 2028, thereby stimulating consumer spending and local economies (Economic Policy Institute, 2024).

The Part-Time Worker Bill of Rights Act also proposes crucial protections for part-time employees, requiring parity in wages, benefits, and access to hours between part-time and full-time roles. For the retail industry, where part-time work is prevalent, this policy could help narrow wage gaps and provide workers with greater economic security (National Employment Law Project, 2024). Together, these legislative efforts reflect a growing recognition of the need for fair wage practices in sectors like retail, where corporate policies alone have often fallen short.

Government Assistance Programs and the Cost of Low Wages

Many low-wage retail workers depend on federal assistance programs, indirectly subsidizing businesses by covering the gap left by insufficient wages. Key programs that support low-wage workers include Medicaid, Supplemental Nutrition Assistance Program (SNAP), Temporary Assistance for Needy Families (TANF), and Section 8 Housing Vouchers.

- Medicaid: Around 12 million working adults rely on Medicaid for health coverage, with retail and food service employees comprising a large portion. When wages fall short, Medicaid fills the healthcare gap. Annually, federal spending on Medicaid and the Children’s Health Insurance Program (CHIP) for working families totals around $152.8 billion

- SNAP: About 9 million working adults benefit from SNAP, a program that helps low-income households afford food. Research indicates that raising the minimum wage by 10% could reduce SNAP enrollment by 2.4% to 3.2%, saving approximately $5.4 billion annually if wages were raised to $15 per hour

- Section 8 Housing and TANF: Housing subsidies and TANF help families meet housing and basic living needs, costing billions yearly. TANF, for example, supports over 2.3 million working families

These assistance programs cost the government approximately $127.8 billion annually, with state contributions adding another $25 billion. About 73% of enrollees in these programs are members of working families, illustrating the extent of public support among employed Americans

Economic Benefits of Increased Wages

Raising wages could reduce dependency on public assistance, freeing up federal funds. A gradual increase to $15 per hour could reduce public spending on SNAP by roughly $3.3 billion as fewer people require food assistance. The Raise the Wage Act could cut public assistance spending by up to $15.5 billion annually due to lower reliance on SNAP, Medicaid, and related programs

Moreover, increased wages drive consumer spending. With more disposable income, workers can spend more in their communities, promoting local businesses and economic growth. Estimates suggest that higher wages could inject up to $45 billion into the economy, boosting labor earnings and benefiting businesses

In sectors like retail, higher wages could alleviate the burden on public assistance programs, reduce taxpayer costs, and foster economic resilience. Prioritizing a living wage not only enhances individual well-being but also benefits the economy, creating long-term, sustainable growth for businesses and communities alike.

The Road Ahead for Retail and Living Wages

The retail sector remains emblematic of the broader challenges associated with wage inequality. As this article has illustrated, retail workers—particularly part-time employees—face substantial barriers to earning a living wage, securing benefits, and achieving economic stability. While companies like Costco demonstrate that competitive wages can lead to stronger workforce outcomes, others like Walmart highlight the limitations of current wage policies, especially when wage growth does not keep pace with corporate profits.

As the retail landscape evolves, corporate accountability and policy reforms will play crucial roles in determining the future of fair wages. By addressing wage disparities and ensuring that retail employees receive compensation commensurate with their essential roles, we can pave the way toward a more equitable economy—one that values all workers, irrespective of their occupation or employment status. This ongoing examination of living wages in the retail sector underscores the urgency of implementing sustainable, fair wage practices that benefit both workers and the broader economy.

As we’ve explored, the retail sector highlights critical challenges in achieving equitable wages and benefits, particularly for part-time and minority workers. Moving forward, our series delves into the food service industry—where wage disparities are equally profound—to examine how companies like McDonald's approach wage practices and their impact on one of the nation's largest groups of minimum-wage employees.

References

- "Living Wage Calculator." Massachusetts Institute of Technology, 2024. https://livingwage.mit.edu/.

- "Retail Worker Salary: Hourly Rate September 2024 USA." ZipRecruiter, 2024. https://www.ziprecruiter.com/.

- "Walmart Benefits Guide." Walmart, 2024.

- "Employee Retention Statistics and Data." Comparably, 2024. https://www.comparably.com/.

- "Mergent Online: Walmart Financial Data." Mergent Online, 2024.

- "The High Public Cost of Low Wages." UC Berkeley Labor Center, 2024.

UC Berkeley Labor Center

ps://laborcenter.berkeley.edu/the-high-public-cost-of-low-wages/) - "Low-Income Workers and Federal GAO

ment Accountability Office (GAO), 2024. https://www.gao.gov

Center for American Progress

P Enrollments and Expenditures." Center for American Progress, 2024. [https://ameri

EPI Files

s://www.americanprogress.org/article/the-effects-of-minimum-wages-on-snap-enrollments-and-expenditures/) - "A $15 Minimum Wage Impact on Federal Budget." Economic Policy Institute, 2024. https://epi.org