As we move through 2025, the United States economy finds itself on uncertain terrain, caught between recovery tailwinds and looming headwinds signaling possible downturns. Policymakers, businesses, and everyday citizens alike find themselves asking the same critical question: Is a recession on the horizon?

Understanding Recessions: The Human Impact

A recession is more than just an economic term; it's a period of significant decline in economic activity that profoundly affects individuals and communities. During a recession, businesses often face reduced demand, leading to layoffs and hiring freezes. Unemployment rates rise, and those who remain employed may experience wage stagnation or cuts. Savings and retirement accounts can diminish as stock markets falter, and the value of homes may decrease, eroding personal wealth. The psychological toll is equally severe—feelings of uncertainty, stress, and hopelessness become widespread as people grapple with financial instability and an unpredictable future. The collective morale of society can decline, leading to decreased consumer spending, which further exacerbates the economic downturn.

Echoes from the Past: Lessons from History

History often provides the clearest lens into our economic future. Looking back, the Gulf War Recession of 1990-1991 arose from high oil prices and restrictive monetary policy, resulting in a GDP decline of 1.5% and peak unemployment of 6.8%. The Dot-Com Bubble of 2001 followed exuberant growth that ended abruptly with stock market crashes and the shocks of 9/11, causing GDP to drop by 0.3%, with peak unemployment at 5.5%. The Great Recession of 2007-2009 was fueled by reckless lending and the housing market collapse, resulting in a 4.3% GDP decline and 9.5% unemployment. The COVID-19 Recession of 2020 was sparked by global lockdowns and supply chain disruptions, causing unemployment to spike sharply to 14.7%.

Today, we see echoes of these historical crises. Indicators such as GDP contraction, market volatility, and declining consumer confidence mirror patterns observed before previous downturns. Although history doesn't repeat exactly, it offers crucial signals that policymakers must heed.

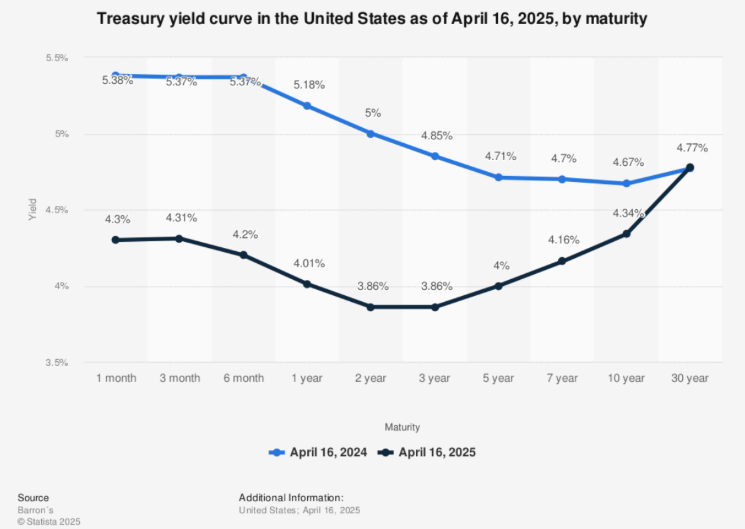

Yield Curve Inversion: A Red Flag Raised

One of the most reliable precursors of recession, the inverted yield curve, occurred again in late 2023. This happens when short-term Treasury yields surpass long-term yields, suggesting investor pessimism about future economic growth. Historically, recessions have followed about six months after yield curve inversions correct, according to JPMorgan research.

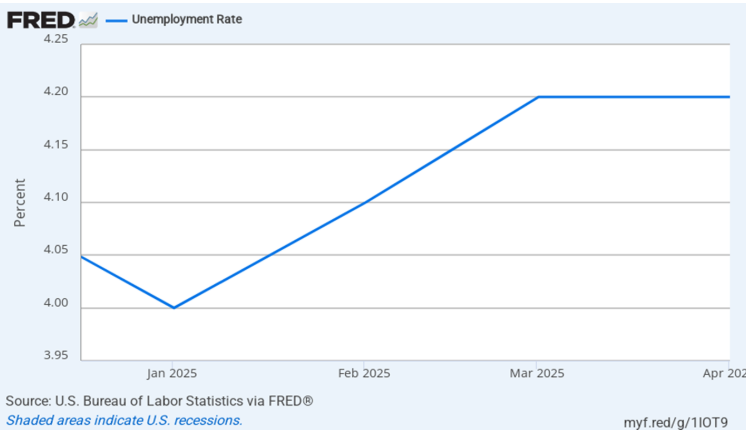

Labor Market: Cracks Emerging

Traditionally resilient, the U.S. labor market is showing subtle but significant cracks. Unemployment rose from 4.0% in January 2025 to 4.2% by March 2025. Job growth in sectors sensitive to interest rates, specifically manufacturing, finance, and technology, has slowed significantly. According to Deloitte forecasts, non-farm payroll (excluding those in the farming sector, private households, and non-profit organizationsgrowth in January 2025 was 143,000, below the 12-month average of 166,000 in 2024, indicating moderation ahead.

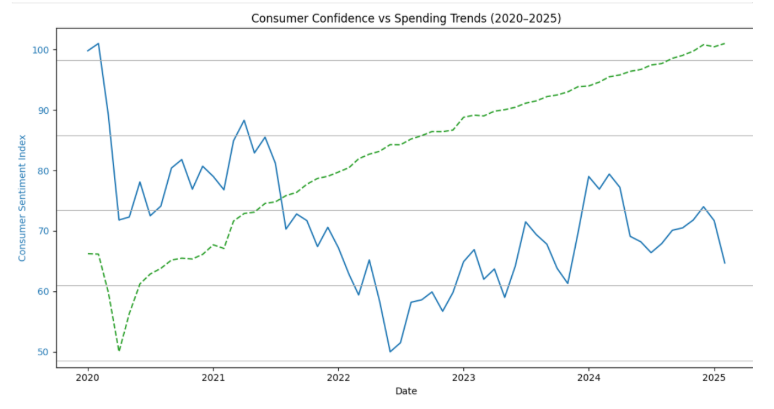

Consumer Confidence: Shaky Ground

The Conference Board's Consumer Confidence Index dropped from 100.1 in November 2024 to 92.9 in March 2025. Particularly concerning is the Expectations Index, measuring consumer outlook, which fell to its lowest level in 12 years, reaching 65.2 in March 2025. This decline signals potential reduced consumer spending, which accounts for nearly 70% of GDP.

Debt Levels Rising: Signs of Financial Distress

Total household debt reached $18.04 trillion by late 2024, up $93 billion from the previous quarter. The New York Fed’s data indicates significant increases in credit card and auto loan delinquencies, particularly among younger and lower-income demographics, potentially amplifying recessionary effects through reduced spending and increased defaults.

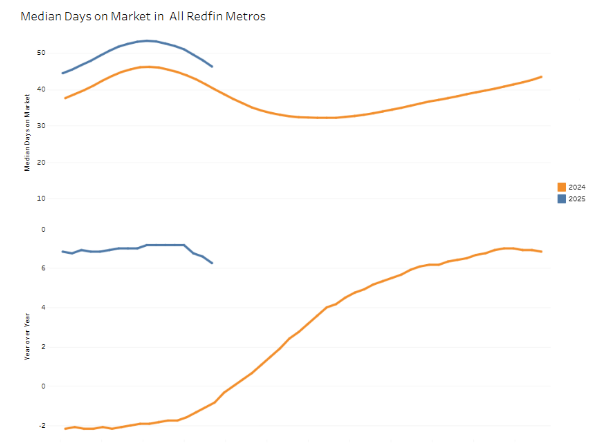

Housing Market: A Canary in the Coal Mine

The U.S. housing market in 2025 exhibits signs of cooling, reminiscent of recessionary patterns. March 2025 saw single-family housing starts decline by 2.0% compared to February 2025, reflecting growing affordability challenges due to high mortgage rates. According to Redfin, 44.4% of home sales in the first quarter included seller concessions—such as covering closing costs or offering repair credits—up from 39.3% a year earlier, indicating sellers' increased efforts to attract buyers amid economic uncertainty. Inventory levels have risen notably, with active listings reaching a five-year high in March, climbing 14.1% year-over-year, providing buyers with more options and signaling a potential shift towards a buyer's market. Homes are also taking longer to sell; the median days on market reached 47 in March, the longest span since March 2020, reflecting decreased buyer urgency. Additionally, the average sale-to-list price ratio has declined to 98%, suggesting that homes sell for less than their asking prices, further underscoring buyers' increasing leverage in negotiations.

Tariff Tensions and Global Uncertainty

The U.S. economy faces substantial uncertainty due to President Trump's renewed aggressive tariff policies in 2025. The implementation of the "Fair and Reciprocal Plan" introduced a universal 10% tariff on all imports, with higher rates imposed on specific countries based on perceived trade imbalances. Notably, Trump quickly imposed a broad 20% tariff targeting Chinese goods, significantly escalating trade tensions with Beijing. Additionally, an unprecedented 25% tariff was levied on imports from Canada and Mexico, and global steel and aluminum tariffs of 25% were reinstated, reversing previous agreements with allies such as the EU and Japan.

These sweeping measures have severely impacted several industries. U.S. agriculture, already vulnerable from previous tariff battles, faces significant losses due to retaliatory tariffs from China, affecting soybeans, pork, and beef exports. Early industry estimates predict billions in lost revenue for American agriculture, potentially necessitating another taxpayer-funded bailout.

The automotive sector, heavily dependent on Canadian and Mexican supply chains, is experiencing increased costs due to tariffs on critical components. This has led American automakers to warn of potential consumer price hikes, job losses, and disruption to longstanding production partnerships across North America.

Globally, the response has been swift and decisive. China implemented a 125% tariff on U.S. goods, escalating the trade conflict significantly. Canada and Mexico have imposed reciprocal 25% tariffs, directly affecting states reliant on exports such as machinery and processed foods. The European Union, Japan, South Korea, and others have expressed disapproval and are exploring potential retaliatory measures or diplomatic negotiations to mitigate impacts.

Financial markets reacted sharply to these developments, with the S&P 500 entering bear territory and over $6 trillion wiped from U.S. stocks. Economists warn of increased inflationary pressures, disrupted supply chains, and slower global economic growth. Billionaire investor Bill Ackman even cautioned about an "economic nuclear winter," urging a tariff pause to prevent further instability.

As tariffs reshape global trade dynamics, U.S. businesses face increased production costs and reduced competitiveness, particularly smaller enterprises with thin profit margins. American consumers, consequently, face rising prices for everyday goods, estimated by the Tax Foundation to cost households over $1,000 annually.

Financial Markets React: Volatility Surges

Heightened economic uncertainty has triggered volatility across financial markets, with the S&P 500 and Nasdaq experiencing fluctuations of over 5% in early 2025. Investors, cautious amid declining corporate earnings forecasts, increasingly seek safer investments such as U.S. Treasuries and gold, reflecting broader risk aversion sentiment.

Policy Responses: A Delicate Balancing Act

Facing these challenges, the Federal Reserve maintained interest rates at 4.25% to 4.5% as of March 2025 to combat inflation. Discussions of potential rate cuts are underway should economic conditions worsen. Fiscal stimulus measures, including infrastructure investments, social program expansions, or direct consumer payments, could provide economic cushioning, though these options face significant political and fiscal hurdles.

The Outlook: A Recession on the Horizon

Analyzing current economic indicators and policy decisions, it becomes increasingly evident that the U.S. is on the cusp of a recession. The aggressive implementation of tariffs under the "Fair and Reciprocal Plan" has strained international trade relations, leading to retaliatory measures from key global partners. These trade tensions have disrupted supply chains, increased production costs, and contributed to market volatility. Historical patterns reveal that such economic downturns are often precipitated by human actions - be it the risky lending practices leading up to the 2008 financial crisis or the mass layoffs during the COVID-19 pandemic despite stable corporate profits. The current trajectory, marked by protectionist trade policies and reactionary measures, mirrors these past missteps. Without a strategic shift towards cooperative economic policies and proactive fiscal measures, the U.S. risks repeating history, plunging into a recession driven not by unforeseen external shocks, but by the decisions and actions of the current administration.