In the intricacies of global economics, both countries and corporations play pivotal roles, contributing distinctive threads to the world's economic and financial tapestry. This briefing opens the curtain a bit on the Gross Domestic Product (GDP) of nations and the Market Capitalization (Market Cap) of corporations, giving insights into their influence, ethical considerations, and power dynamics and raising the questions of accountability and responsibility to global citizens and the planet.

The Titans on the World Stage

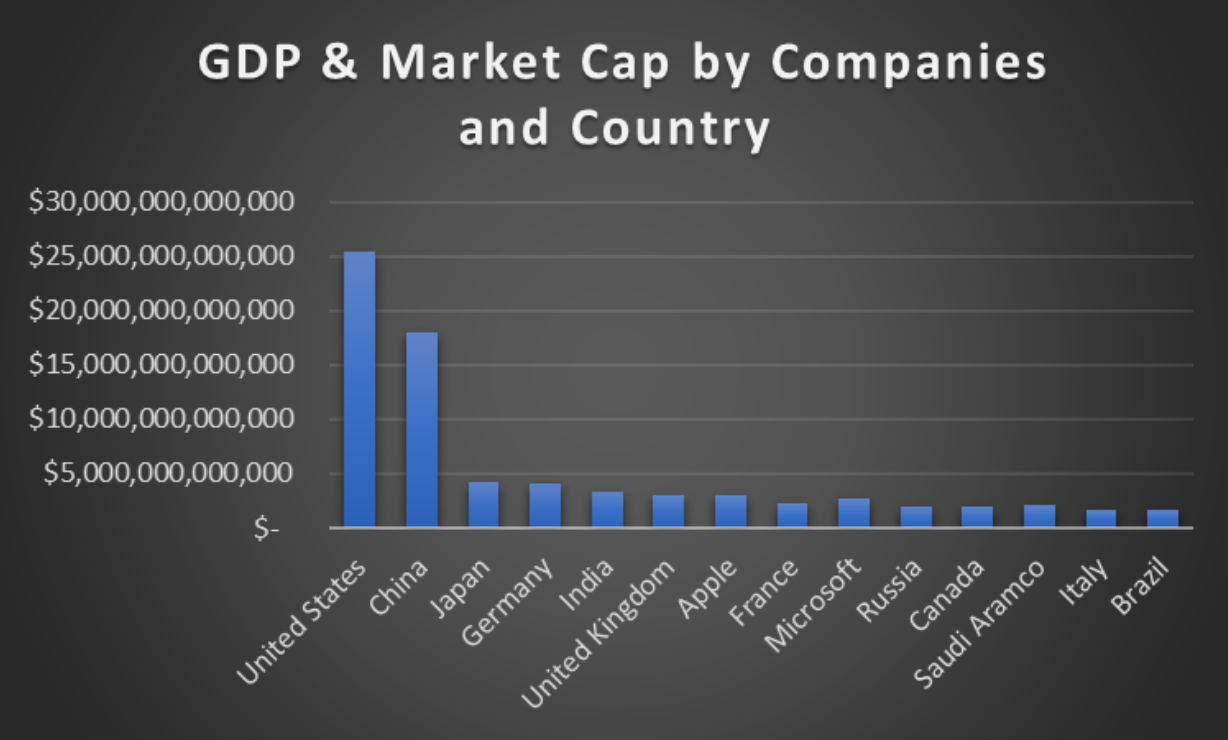

Countries (by GDP):

- United States: $25.46 trillion

- China: $17.96 trillion

- Japan: $4.23 trillion

- Germany: $4.07 trillion

- India: $3.39 trillion

- United Kingdom: $3.07 trillion

- France: $2.24 trillion

- Russia: $2.01 trillion

- Canada: $1.92 trillion

- Italy: $1.67 trillion

Companies (Market Cap):

- Apple: $3.05 trillion

- Microsoft: $2.77 trillion

- Saudi Aramco: $2.14 trillion

- Alphabet (Google): $1.71 trillion

- Amazon: $1.59 trillion

- NVIDIA: $1.24 trillion

- Meta Platforms (Facebook): $885.63 billion

- Tesla: $801.34 billion

- Berkshire Hathaway: $784.61 billion

- Visa: $531 billion

Influence, Ethics, and Power Dynamics

Countries:

Traditionally, countries have wielded power through political, military, and economic means, shaping international relations and global policies. Ethical considerations extend beyond financial metrics, encompassing human rights, social justice, and environmental stewardship.

Corporations:

In contrast, corporations navigate the terrain of profitability, facing scrutiny for ethical conduct, sustainable practices, and social responsibility. Tech giants, especially social media companies, grapple with privacy concerns, while energy behemoths face challenges related to environmental impact.

The Power Play

Countries:

Nations leverage diplomatic ties, military strength, trading partnerships and international alliances to exert influence. Superpowers like the United States and China engage in geopolitical maneuvers that reverberate across the global stage.

Corporations:

Corporations, especially in the tech and energy sectors, wield economic influence that can shape public opinion, impact elections, and mold global markets. Meta Platforms (Facebook) stand out, holding significant sway over online discourse.

Trends and Intriguing Insights

- Tech Ascendancy: The dominance of technology companies is evident, with Apple, Microsoft, Alphabet (Google), and NVIDIA securing top spots in market cap.

- Energy Monolith: Saudi Aramco's colossal market cap underscores the immense influence of the energy sector, highlighting the power held by oil and gas corporations.

- E-commerce Revolution: Amazon's substantial market cap reflects the transformative impact of the e-commerce revolution on the retail landscape.

- Sector Diversity: Companies like Visa and UnitedHealth showcase the diversity in sectors, with finance and healthcare playing pivotal roles.

Navigating the Economic Landscape

The comparison between country GDPs and company market caps paints a vivid picture of a dynamic global economic landscape. As we witness the ebb and flow of power between nations and corporations, the ethical responsibilities of these entities and the delicate balance between profitability and societal impact remain paramount.

Current Challenges: Apple vs. Indian Government

The recent clash between Apple and the Indian government highlights the intricate balance tech companies face when dealing with assertive political entities. After Apple issued warnings to independent Indian journalists and politicians about potential state-sponsored iPhone hacking attempts, the current Indian administration swiftly questioned Apple's security measures publicly and pressured the company privately to downplay the political impact of the alerts. This incident not only underscores the challenges faced by tech giants in navigating the demands of powerful governments but also sheds light on broader concerns about government surveillance and interference in the public life of citizens. The tension highlights the delicate balance of truth and justice in society and how companies and governments must do their part to ensure that balance with broader societal consensus and regulatory framework.

In this series of briefings, we will share ideas on nuanced approaches aimed at ensuring sustainable and equitable growth on both national and corporate fronts while preserving the health of the planet and equitable human development across the globe. We welcome your comments and contributions