The U.S. healthcare system stands at a pivotal crossroads, shaped by the actions of three corporate giants: UnitedHealth Group (UHG), CVS Health, and McKesson. Together, these companies influence the trajectory of care delivery, affordability, and access for millions of Americans. Yet their dominance raises critical questions: Are these corporations advancing patient well-being or are they prioritizing profits over care? By examining their operations, financials, and controversies, we can better understand their role in reshaping healthcare and the potential risks to stakeholders.

UnitedHealth Group: Vertical Integration on Trial

UnitedHealth Group’s position as the largest healthcare company in the world rests on its deeply integrated business model. With UnitedHealthcare, as its insurance arm, Optum, which encompasses pharmacy benefit management (PBM) through OptumRx, and care delivery through Optum Health, UHG commands significant influence over both access to and the cost of health care.

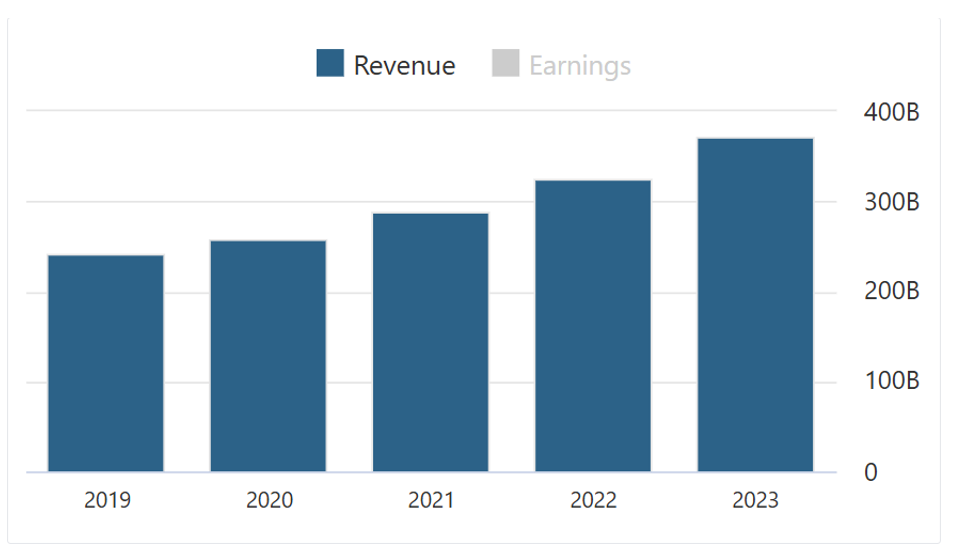

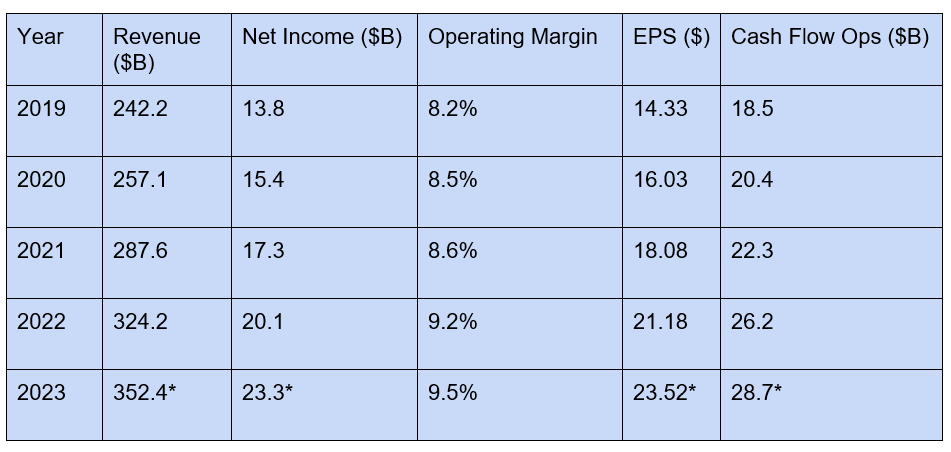

Key Financials

- 2023 Revenue: $352.4 billion (estimated)

- Net Income: $23.3 billion (estimated), reflecting consistent growth

- Operating Margin: 9.5%, among the highest in the sector

- EPS Growth: Driven by aggressive share buyback, which enhances shareholder returns, UHG invites criticism for sidelining investments instead of patient care

Share Buybacks and Investments:

UHG has consistently engaged in share repurchase programs, enhancing shareholder value. While these buybacks indicate strong financial health, questions arise regarding the allocation of capital and whether increased investments in patient care or premium reductions might better serve societal interests.

Key Financial Metrics (2019–2023):

Estimated for FY 2023

Consumer and Workforce Concerns

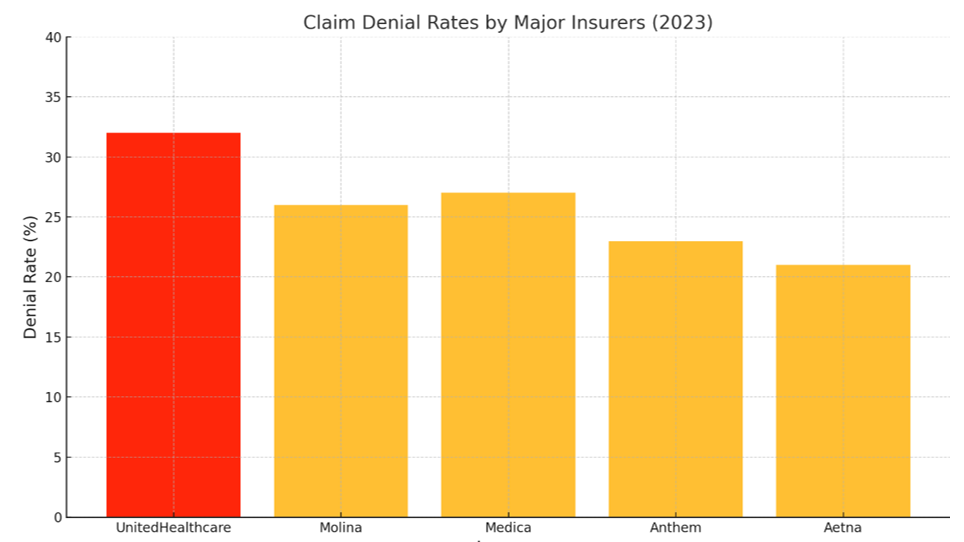

- Customers: UHG’s dominance often translates into high claim denial rates and opaque pricing structures, leaving patients burdened with unexpected costs. Innovations like telehealth have improved patient access, but public trust remains fragile.

- Employees: With nearly 400,000 employees globally, UHG offers competitive salaries for technical and analytical roles but faces allegations of overworking healthcare staff, leading to burnout in critical and patient care positions.

- Shareholders: A consistent focus on financial returns has made UHG a solid investment on Wall Street. Critics however point out that UHG’s shareholder-first approach comes at the expense of broader societal benefit.

Key Controversy

The December 2024 murder of UnitedHealthcare CEO Brian Thompson allegedly by Luigi Mangione added unprecedented scrutiny to the company’s operations. This tragic event highlighted the immense pressure of healthcare leadership and initiated public and regulatory scrutiny on industry challenges in the health industry.

CVS Health: Expanding Beyond the Counter

CVS Health has transformed itself from a retail pharmacy into a healthcare behemoth. With the $69 billion acquisition of Aetna in 2018, CVS integrated health insurance, retail pharmacy, and PBM services under one roof, positioning itself as both a competitor and collaborator with UHG.

Key Financials

- 2023 Revenue: $357.8 billion.

- Net Income: $8.3 billion; however, profitability dipped sharply in 2024 due to rising medical costs and setbacks with Medicare Advantage.

- Stock Price Decline: A 26% drop in 2024 reflects market concerns about financial stability and leadership uncertainty.

Stakeholder Challenges

- Customers: While MinuteClinics and HealthHUBs have expanded access, low consumer ratings (e.g., 1.8/5 on Sitejabber) point to dissatisfaction with service quality and transparency.

- Employees: CVS employs 300,000 people, offering competitive pay for pharmacists but leave frontline staff such as pharmacy technicians underpaid relative to living wages.

- Shareholders: Leadership transitions, including the replacement of CEO Karen Lynch with David Joyner, have shaken investor confidence.

Market Dynamics

The CVS-Aetna merger exemplifies vertical integration but raises antitrust concerns. Critics argue that the merger limits consumer choice by steering Aetna’s 22 million subscribers toward CVS-owned pharmacies and clinics, effectively stifling competition.

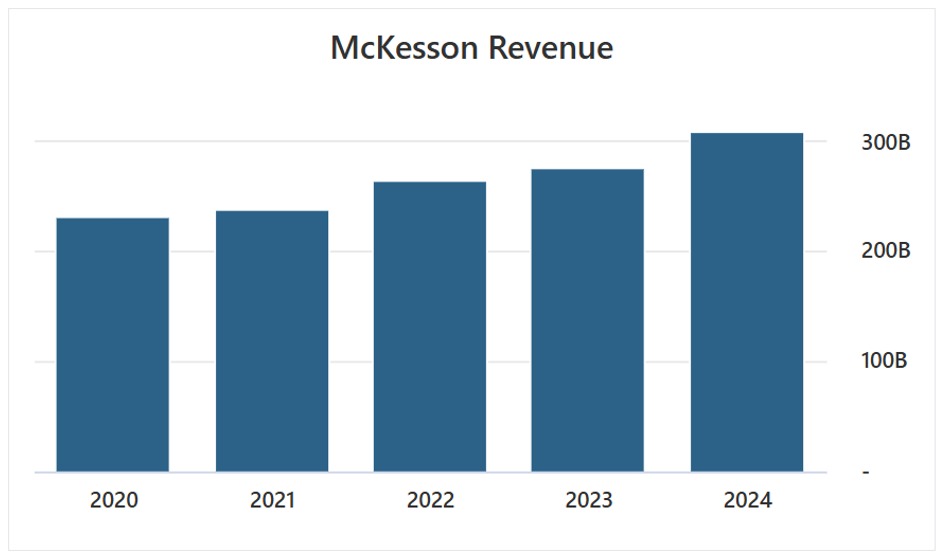

McKesson: The Quiet Giant of Healthcare Logistics

Founded in 1833, McKesson occupies a vital but less visible role as the backbone of the healthcare supply chain. The company connects pharmaceutical manufacturers to providers, ensuring timely delivery of medications while maintaining regulatory compliance and product integrity.

Key Financials

- 2023 Revenue: $276.71 billion.

- Net Income: $3.56 billion, recovering from a $4.54 billion loss in 2021 due to opioid litigation.

- Operating Margin: A modest 1.3%, reflecting its high-volume, low-margin model.

- Workforce Optimization: Employee reductions (from 75,000 in 2022 to 51,000 in 2023) boosted revenue per employee to $5.43 million but strained morale.

Challenges and Opportunities

- Customers: McKesson’s partnership with insurers like UHG and retail pharmacies like CVS significantly influence drug pricing and availability. However, the company’s complex rebate structures have been criticized for contributing to price inflation.

- Employees: Workforce reductions have increased efficiency but led to concerns about fair compensation and employee well-being.

- Shareholders: Strong free cash flow ($4.6 billion in 2023) and strategic divestitures underscore McKesson’s focus on financial discipline.

How They Fit Together

The interplay between UHG, CVS, and McKesson reveals a complex web of collaboration and competition:

- Pharmacy Benefit Management: UHG’s OptumRx and CVS Caremark manage drug pricing and formularies, relying heavily on McKesson’s logistics capabilities.

- Care Delivery: UHG’s Optum Health competes with CVS’s MinuteClinics and HealthHUBs, while both companies depend on McKesson to supply medications.

- Drug Pricing: While PBMs negotiate rebates, McKesson’s intermediary fees add layers of complexity, often inflating patient costs.

Mapping the Connections

The interactions among UnitedHealth Group (UHG), CVS Health, and McKesson form the backbone of the U.S. healthcare ecosystem. Their collaboration spans key areas such as drug pricing, distribution, and care delivery, while their competition defines market dynamics. Understanding this flow is critical to analyzing how these organizations impact patient care and affordability.

- Drug Manufacturers:

- The flow begins with drug manufacturers, who produce medications and rely on McKesson for efficient distribution. As the primary logistics intermediary, McKesson ensures these drugs reach retail pharmacies, hospitals, and healthcare providers.

- McKesson: The Supply Chain Backbone:

- McKesson connects manufacturers to PBMs and healthcare providers. Its advanced logistics systems and cold-chain capabilities ensure medications, including temperature-sensitive drugs, are delivered promptly and safely. The company also manages regulatory compliance, serving as a neutral facilitator between supply and demand.

- Pharmacy Benefit Management (PBM):

- PBMs, operated by UHG’s OptumRx and CVS Caremark, manage the pricing and formulary placement of drugs distributed by McKesson. These entities negotiate rebates with manufacturers, determining which drugs are covered under insurance plans and at what cost. The decisions made at this stage directly affect drug affordability and patient access.

- UnitedHealth Group and CVS Health: Diverging and Converging Roles:

- UHG and CVS operate both collaboratively and competitively:

- UHG, through UnitedHealthcare, leverages OptumRx’s PBM services and uses McKesson for medication logistics.

- CVS, as both a retailer and insurer (via Aetna), integrates McKesson’s distribution services while offering its own PBM solutions.

- Both companies extend these services to patients via their respective care delivery models: Optum Health for UHG and HealthHUBs/MinuteClinics for CVS.

- UHG and CVS operate both collaboratively and competitively:

- Patients and Providers:

- The final step in the flow is the delivery of medications and services to patients. Providers depend on this tightly coordinated system to ensure timely care, while patients bear the financial burden of decisions made upstream, including PBM negotiations and distribution fees.

Impact on Stakeholders

Patients

Patients remain at the mercy of opaque pricing structures and limited competition. Vertical integration among these corporations narrows consumer choice, steering patients toward in-house services while keeping true costs hidden.

Employees

Burnout and wage disparities are systemic across all three organizations, undermining workforce morale and raising questions on long-term sustainability.

Shareholders

Investors in all three companies enjoy strong returns, but growing regulatory scrutiny and public dissatisfaction present risks to their business models.

Recommendations

- Increase Transparency:

- Simplify drug pricing and rebate systems to empower patients with clearer cost information.

- Invest in Workforce Well-Being:

- Address wage disparities and burnout to build a more resilient healthcare workforce.

- Shift Toward Value-Based Care:

- Prioritize long-term patient outcomes over short-term financial gains.

Whether intentional or unavoidable, the complexity of the U.S. healthcare system ultimately works against the very patients it is designed to serve. For those in need of care, the interplay among UHG, CVS, and McKesson often translates to confusion, inflated costs, and limited choices. Simplifying this system is not merely a matter of operational efficiency; it is a moral imperative.

UnitedHealth Group, CVS Health, and McKesson are undeniably central to the U.S. healthcare system, but their intertwined dominance raises critical ethical and operational questions. As these giants navigate regulatory scrutiny and public discontent, the challenge is clear: to recalibrate priorities and place patient well-being at the heart of their operations. Only by doing so can they fulfill their potential to lead not just an industry, but a transformation in healthcare.

References

- UnitedHealth Group's Role in Pharmacy Cost Management

UnitedHealth Group. “Pharmacy Care Services: Reducing Costs Through Alternative Drug Administration.”

Available at UnitedHealthGroup.com - OptumRx Value-Based Pricing Initiative

Reuters. “UnitedHealth’s OptumRx Announces New Drug Pricing Model to Link Costs to Patient Outcomes.” May 20, 2024.

Available at Reuters.com - Overview of Pharmacy Benefit Managers (PBMs)

“Pharmacy Benefit Management.” Accessed December 2024. - UnitedHealth Group’s 2023 Financial Report

UnitedHealth Group. “2023 Annual Report and Form 10-K.”

Available at UnitedHealthGroup.com - ERISA Class-Action Settlement

Consumer Affairs. “UnitedHealth to Pay $69 Million in Class-Action Suit Alleging Fiduciary Breaches.” December 2023.

Available at ConsumerAffairs.com - CEO-Related Scrutiny on Claim Denials

MarketWatch. “Healthcare CEO's Killing Shines Light on Health Insurance Denial Rates.” December 2023.

Available at MarketWatch.com - UnitedHealth Group Financial Metrics (2019–2023)

UnitedHealth Group. “Investor Relations: Quarterly Earnings and Historical Performance Data.”

Available at UnitedHealthGroup.com