Introduction

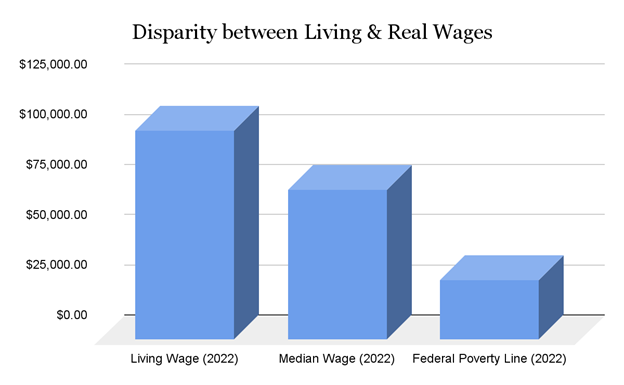

A living wage recognizes that life is more than work and has profound social implications for communities and families. It acknowledges that workers are people first and should work to live, not live to work. In 2022, the median living wage in the United States was an estimated $25.02 per hour or $104,077.70 per year for a family of four[1]. This figure, derived from MIT's Living Wage Calculator, reflects the minimum income needed to cover housing, food, childcare, transportation, healthcare, and taxes. The same year, American households made a median wage of $74,580, meaning most Americans earn 70% or less of a living wage[2]. In 2022, 37.9 million Americans lived below the federal poverty line[3]. The federal poverty line was set at $29,678 for a family of four, indicating that these families needed an additional $74,399.70 to reach the median living wage in the United States.[4]. This data contrasts sharply with the following year’s figures, where the top 10% of earners held 66.9% of the total wealth in the United States, while the bottom 50% held just 2.5%.[5]. The stagnation of real wages in the United States since the 1980s and the decline in the share of American adults living in middle-income households—from 61% in 1971 to 51% in 2019—highlights a growing economic disparity[6]. Despite these clear indicators of inequity in the distribution of wealth, the conversation around wages continues to be dominated by the interests of businesses rather than the interests of most Americans. It is long overdue for all Americans to receive a wage that ensures they can afford healthcare, provide for their families, and live a dignified life without being trapped in a cycle of economic hardship. We must re-center the conversation regarding wages on the fundamental principles of equity, morality, and democracy that guide our nation to a better future. Ensuring a living wage is a step toward fostering a society that values human dignity and well-being over mere economic output.

Economic Benefits

Paying a living wage is a moral imperative and an economic boon. Economic research supports that higher salaries create jobs and benefit businesses by boosting worker morale[7], improving workers' health, enhancing the quality of service, and increasing worker retention rates. First, higher wages have been shown to boost worker morale. Employees who feel valued and fairly compensated are more motivated, engaged, and productive. This boost in morale can translate into a more positive work environment and greater overall job satisfaction, which is essential for individual well-being and company culture. In addition to morale, paying a living wage significantly improves workers' health. Financial stability allows employees to afford better nutrition, healthcare, and living conditions, reducing stress and the incidence of chronic illnesses. Healthier employees mean fewer sick days and lower healthcare costs for employers, contributing to a more stable and reliable workforce. Enhanced quality of service is another critical benefit of higher wages. When paid well, employees are more likely to take pride in their work and strive for excellence. This commitment to quality can lead to higher customer satisfaction and loyalty, vital for business success and growth.

Moreover, higher wages reduce turnover rates, saving money for employers in the long run. The costs of recruiting, hiring, and training new employees can be substantial. Businesses can retain their staff longer by offering competitive wages, preserving institutional knowledge, and maintaining operational continuity. Reduced turnover fosters a more experienced and cohesive team, enhancing productivity and innovation[8]. Several real-world examples illustrate these benefits. Paying a living wage is a moral obligation and a strategic economic advantage. It fosters higher worker morale, improves health, enhances service quality, and reduces turnover, ultimately contributing to a more productive and stable workforce.

Economic Injustice and Its Roots

The stark disparity between those living under constant economic burden and those amassing wealth equivalent to some countries' GDP highlights a profound injustice. A child's economic prospects are primarily dictated by their family's circumstances[9], indicating that early-life resources more influence economic positions than individual effort or work ethic. This lack of economic mobility perpetuates cycles of poverty, undermining the meritocratic ideal that success should be based on talent and effort rather than socioeconomic status at birth.

In addition, the exponential growth of billionaire wealth, increasing by 88 percent in the past four years in the U.S.[10], underscores the widening gap between the richest and the rest of society. This concentration of wealth not only exacerbates economic inefficiency but also poses ethical concerns. It leads to a power imbalance where the wealthy significantly influence political processes, undermining democratic values and eroding social cohesion. As inequality rises, crime rates, social unrest, and community divisions weaken the social fabric and hinder economic growth and democratic functioning[11]. Addressing wealth inequality is essential for creating a just society where everyone can achieve a decent quality of life.

Societal Impact of Wealth Inequality

Wealth inequality profoundly impacts various aspects of society, notably health and educational opportunities, perpetuating cycles of poverty. Low-income individuals often struggle to afford medical care, leading to poorer health outcomes and higher rates of chronic diseases such as high blood pressure, obesity, and mental illness[12]. This lack of access to healthcare further entrenches poverty. In education, funding disparities tied to local taxes result in lower-quality schooling in impoverished areas, limiting higher education and better job opportunities for students from these communities. This educational inequality perpetuates economic disparities, as higher education is critical to securing higher-paying and less physically demanding jobs.

Economically, sustained inequality imposes significant social costs. It undermines educational and occupational choices and incentivizes rent-seeking behaviors, leading to resource misallocation, corruption, and diminished institutional trust. Research by the IMF shows that higher income inequality, as measured by the Gini coefficient, negatively affects economic growth and sustainability. A more equitable income distribution, significantly increasing the income share of the bottom 20 percent, correlates with higher economic growth. Addressing wealth inequality through progressive taxation, improved access to education, and robust social safety nets can stimulate the economy, foster innovation, and create a more cohesive, productive, and fair society.

PayPal's Financial Wellness Initiative

In discussing the broader economic benefits of paying a living wage, it is essential to consider real-world examples of companies implementing initiatives to improve their employees' financial well-being. One example is PayPal's Financial Wellness Initiative, which has demonstrated significant positive outcomes for workers and the company. Before the initiative, a substantial portion of PayPal employees faced financial instability. In 2019, 65% of PayPal employees reported running out of money between paychecks, and nearly one-third needed help to cover an unexpected expense. Recognizing the detrimental impact of financial stress on its workforce, PayPal launched the Financial Wellness Initiative, which included reducing healthcare costs, granting stock awards, raising wages where appropriate, and providing access to personal financial education. This holistic approach aimed to improve employees' financial stability and overall well-being[13].

Significant Improvements and Outcomes

The results of the Financial Wellness Initiative were profound. By early 2020, just a few months after the initiative was introduced, significant improvements were observed:

● Financial Wellness: Fewer employees ran out of money between paydays, and there was an increased willingness to use financial health improvement apps.

● Employee Retention: 76% of respondents intended to stay at PayPal for at least five years, up from 51% in 2018.

● Turnover Rates: Global average turnover at customer service centers dropped from 19.4% in 2019 to 7.3% in 2020.

● Productivity and Engagement: Increased productivity, higher net promoter scores (a measure of customer loyalty), and overall engagement scores increased to 84, placing PayPal in the top five percent of benchmark technology companies.

● Employee Participation and Long-term Benefits

○ The initiative led to increased participation in financial programs:

■ Nearly half of hourly and entry-level employees chose to participate in the Employee Stock Purchase Plan.

■ Over two-thirds enrolled in the PayPal 401(k) plan.

■ The minimum estimated Net Disposable Income (NDI) for hourly and entry-level employees in the U.S. reached 11%, and the company aims to raise this to 20% globally.

These improvements translated to tangible employee benefits, such as paying down debt, buying vehicles to commute to work, sending children to daycare, and affording healthcare without financial stress[14].

PayPal's Financial Wellness Initiative exemplifies how paying a living wage and investing in employees' financial well-being can substantially benefit workers and employers. By prioritizing its employees' financial health, PayPal has demonstrated that businesses can thrive while ensuring their workers are adequately compensated. This initiative provides a blueprint for other companies to follow, highlighting that a commitment to paying a living wage is both a moral obligation and a strategic economic advantage. PayPal's Financial Wellness Initiative underscores the numerous benefits of paying a living wage, including improved financial stability, reduced healthcare costs, enhanced employee morale, and increased retention. It compellingly supports the broader argument for the necessity and feasibility of ensuring all workers receive a living wage, ultimately contributing to a more just and prosperous society.

Walmart

As one of the world's largest private employers, Walmart can significantly influence labor market standards. With over 2.2 million associates globally and approximately 1.6 million in the United States, the company's wage policies impact a substantial portion of the workforce. While Walmart's current average hourly wage of $17/hour is above the federal minimum wage, it still falls short of the average living wage of $24.38/hour in the United States. Given its substantial annual revenue, this analysis examines the feasibility of Walmart increasing wages and meeting the living wage standard, highlighting the financial implications and potential positive effects on the workforce.

Wage Difference

The difference between the average living wage and the current average hourly wage is:

$24.38 - $17 = $7.38

Number of Full-Time and Part-Time Associates

● Total Associates in the US: 1,600,000

● Full-Time Associates: 68% of 1,600,000

● 1,600,000 * 0.68 = 1,088,000

● Part-Time Associates: 32% of 1,600,000

● 1,600,000 * 0.32 = 512,000

Annual Work Hours

Assumptions:

● Full-Time: 40 hours/week, 52 weeks/year

● 40 hours/week * 52 weeks/year = 2,080 hours/year

● Part-Time: 25 hours/week, 52 weeks/year

● 25 hours/week * 52 weeks/year = 1,300 hours/year

Total Cost to Increase Wages to Living Wage

Calculations for annual cost:

Full-Time Associates:

1,088,000 full-time associates * 2,080 hours/year * $7.38/hour = $16,701,235,200

Part-Time Associates:

512,000 part-time associates * 1,300 hours/year * $7.38/hour = $4,915,200,000

Total Annual Cost:

$16,701,235,200 + $4,915,200,000 = $21,616,435,200

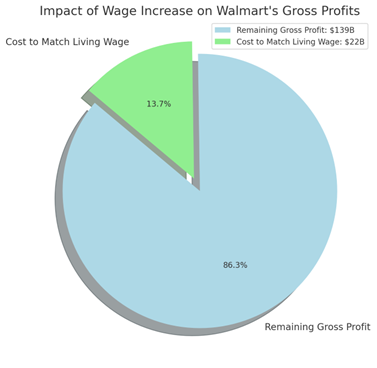

Raising Walmart associates' average hourly wage to the living wage standard would cost approximately $21.62 billion annually. Given Walmart's annual revenue of $648.125 billion in 2024, this expense would constitute roughly 3% of its revenue. This analysis indicates that, from a budgetary standpoint, Walmart could feasibly allocate the necessary funds to ensure its employees earn a living wage, thereby setting a positive precedent in labor market standards.

“The pie chart illustrates that Walmart would need to spend $22 billion out of its $161 billion profits to raise employee wages to the living wage, leaving $139 billion in remaining profits.”

Walmart's annual net income for 2024 was $15.511B, a 32.8% increase from 2023:

Net Income for 2024:

● Total Net Income: $15.511 billion

Total Dividends and Buybacks for 2024:(Calculated based on the sub10-K)

● Dividends Paid: $6.140 billion

● Share Buybacks: $2.779 billion

● Total Paid in Dividends and Buybacks: $6.140 billion + $2.779 billion = $8.919 billion

Remaining Net Income After Dividends and Buybacks:

● Calculation: $15.511 billion (Net Income) - $8.919 billion (Dividends and Buybacks)

● Remaining Profit: $15.511 billion - $8.919 billion = $6.592 billion

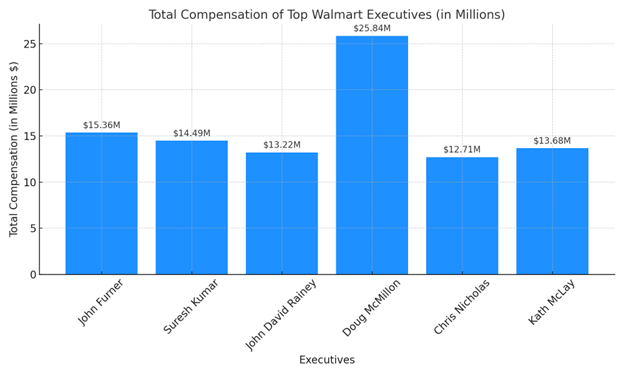

[Data Represented as per Salary.com(Employer-reported Data)]

Walmart allocates a significant portion of its revenue to executive compensation. While executives play a crucial role in the growth and functioning of the business and deserve to be well compensated, this should not come at the expense of employees struggling to meet their basic needs. Compared to other top retail giants, many of Walmart's executives rank among the highest-paid in the industry. Each of these executives should consider life with less than living wages for themselves and bring genuine empathy in the conversation about living wages for their employees whose hard work enables them to allocate such exorbitant salaries. On a policy level, Federal and State agencies should consider mandating a gradual shift to living wages for all companies, using a similar logic used for auto companies to reduce their emissions year after year. A cursory look at their current asset, operating income, and retained earnings makes such a scenario reasonable and doable. The question is: do Walmart's board, its executives, and its shareholders have the financial, economic foresight, and moral clarity, and will Wall Street analysts look at the longer-term economic prospect rather than short-term dividends and stock price as indicators of business success?

Statistics Representing How Walmart Employees are Affected:

We have previously explored how PayPal has reaped financial benefits and enhanced employee productivity by implementing an employee-first policy. Let’s examine some of Walmart’s statistics to contrast the two companies. Although PayPal and Walmart operate in different sectors and serve other purposes, our focus here is on employee welfare. Regardless of the industry, the human element remains constant—employees across all sectors face similar challenges and have comparable needs. By comparing these two companies, we can gain insights into how different approaches to employee welfare can impact overall outcomes.

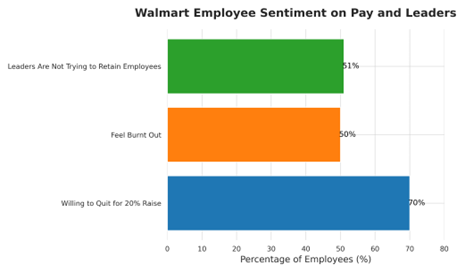

Let’s look at a few Walmart employee statistics:

● Approximately 70% of Walmart employees, particularly retail sales associates, would consider leaving their current positions for just a 20% raise.

● Nearly half the workforce reports feeling burnt out, with inadequate pay significantly contributing.

● Many employees feel their compensation needs to fairly reflect the amount of work they do.

● Additionally, more than 50% of employees believe that company leaders should do more to retain talent.

As we can see, failing to meet a living wage impacts employees financially and leaves them feeling undervalued, burnt out, and insecure in their current roles. At Walmart, nearly 50% of core employees (retail sales associates) are dissatisfied with their pay. Despite this, the company continues to generate over $150 billion in annual profits. Walmart should recognize the potential impact of investing $19.47 billion to help employees achieve a living wage. Such an investment could transform employees' lives and significantly benefit the company. Happier, more productive, and motivated employees could drive even greater profits and give Walmart a more competitive edge. This way, Walmart can not only change the lives of 1.6 million people but put itself on a path to becoming one of the greatest companies, making great profits while being considerate of its employees.

Conclusion

Walmart has shown strong performance over the past year and continues to perform well economically. After covering dividends and buybacks, Walmart retained approximately $6.5 billion in profits in 2024. By investing a portion of these profits yearly to raise employee wages to a living wage, Walmart could enhance employee motivation and well-being. This strategy could lead to a significant profit increase, similar to what PayPal experienced following its wage improvements. Improved employee satisfaction and financial stability can enhance productivity and customer service, contributing to greater profitability. Although it is a small amount compared to net income, Walmart can surely make some executive-level pay cuts and channel that toward their lower-income employees. All this will eventually make Walmart better in financial and humanitarian terms.

Counterarguments and Rebuttals

Critics of the living wage often cite concerns about reduced profits, competition, relocation, inflation, job losses, business viability, employee productivity, and organizational costs. However, these concerns can be mitigated through strategic policies and practices, ensuring equitable access to necessities without compromising business sustainability.

One of the main fears of raising wages is that businesses will face increased competition and may relocate to areas with cheaper labor. To counter this, legislation and regulations can establish ethical wage standards, ensuring businesses adhere to fair pay practices. This levels the playing field and reduces the incentive for businesses to relocate in search of cheaper labor. Additionally, governments can offer tax breaks, grants, or other incentives to companies that comply with living wage standards, encouraging them to stay and invest locally. Including labor standards in international trade agreements can prevent companies from relocating to lower-wage countries, promoting fair wages globally.

Raising wages can also have a positive impact on the economy. Workers with a higher disposable income are more likely to spend on goods and services, boosting demand and contributing to economic growth. This increased consumer spending can improve business sales and profits, helping balance the higher wage costs. Furthermore, fairly compensated employees are more likely to feel satisfied and provide better customer service, increasing customer loyalty and higher sales.

Businesses must ensure their practices do not exploit employees. Strengthening labor laws can protect workers from exploitation and ensure they receive fair compensation. Encouraging businesses to adopt corporate social responsibility (CSR) practices can promote fair wages and ethical treatment of employees as part of a company’s core values. Facilitating employee representation through unions or worker councils can ensure that workers have a voice in negotiations over wages and working conditions.

It is essential to embed protections in governance structures to ensure all employees receive livable wages. One way to achieve this is by implementing certification programs for businesses that pay a living wage to recognize and promote ethical business practices. Additionally, establishing government bodies to oversee and enforce living wage laws can ensure compliance and promptly address violations. Lastly, raising public awareness about the benefits of living wages can create consumer demand for ethically produced goods and services, thus encouraging businesses to adopt fair wage practices.

Ultimately, businesses should not be designed to exploit employees. Protections must be built into governance structures to ensure all employees earn a livable wage. Addressing these potential negatives comprehensively allows for a balanced approach that promotes fair wages while supporting business sustainability and economic growth.

Conclusion

Ensuring a living wage for all Americans is not just a matter of economic policy but a moral imperative. It is essential to recognize that workers deserve to live dignified lives, free from financial hardship. The data clearly show that many Americans are not earning enough to meet basic needs, and the wealth disparity in the country is growing. We can address these inequalities by implementing policies that ensure fair wages and promote a more just society. The examples of companies like PayPal demonstrate that paying a living wage can lead to numerous benefits for both employees and employers, including increased productivity, better health outcomes, and higher employee retention. While there are concerns about the potential negative impacts of raising wages, these can be mitigated through strategic policies and practices. It is time to refocus the conversation on wages around the principles of equity, morality, and democracy, ensuring that all Americans have the opportunity to live dignified and fulfilling lives.

[1]“Glasmeier, Amy. 2023. “Living Wage Calculator.” Livingwage.mit.edu. February 1, 2023. https://livingwage.mit.edu/articles/103-new-data-posted-2023-living-wage-calculator#:~:text=An%20analysis%20of%20the%20living.

[2]“Median Household Income U.S. 2021.” 2024. Statista. Statista. July 5, 2024. https://www.statista.com/statistics/200838/median-household-income-in-the-united-states/#:~:text=This%20statistic%20shows%20the%20median.

[3] “Median Household Income U.S. 2021.” 2024. Statista. Statista. July 5, 2024. https://www.statista.com/statistics/200838/median-household-income-in-the-united-states/#:~:text=This%20statistic%20shows%20the%20median.

[4]US Census Bureau. 2023. “Income, Poverty and Health Insurance Coverage in the United States: 2022.” Census.gov. September 12, 2023. https://www.census.gov/newsroom/press-releases/2023/income-poverty-health-insurance-coverage.html.

[5]“U.S. Wealth Distribution in 2016.” 2022. Statista. Statista. 2022. https://www.statista.com/statistics/203961/wealth-distribution-for-the-us/.

[6]Kochhar, Rakesh, and Stella Sechopoulos. 2022. “How the American Middle Class Has Changed in the Past Five Decades.” Pew Research Center. Pew Research Center. April 22, 2022. https://www.pewresearch.org/short-reads/2022/04/20/how-the-american-middle-class-has-changed-in-the-past-five-decades/.

[7] Alam, Mohammad, Md Mahmudul Hassan, Dorothea Bowyer, and Md Reaz. 2020. “Postsecondary National Policy Institute Black Students in Higher Education CENSUS OVERVIEW.” Australasian Accounting Business and Finance Journal.

[8] Kujawski, Kasia . 2022. “Minimum Wage Is Not Enough.” Center for Hunger Free Communities. Drexel University. April 8, 2022. https://drexel.edu/hunger-free-center/research/briefs-and-reports/minimum-wage-is-not-enough/#:~:text=Improved%20Employee%20Retention%20and%20Productivity.x

[9] “Parental Income Has Outsized Influence on Children’s Economic Future.” 2015. Pewtrusts.org. July 23, 2015. https://www.pewtrusts.org/en/about/news-room/press-releases-and-statements/2015/07/23/parental-income-has-outsized-influence-on-childrens-economic-future.

[10] “Updates: Billionaire Wealth, U.S. Job Losses and Pandemic Profiteers.” 2024. Inequality.org. April 18, 2024. https://inequality.org/great-divide/updates-billionaire-pandemic/#:~:text=Total%20U.S.%20Billionaire%20Wealth%3A%20Up%2088%20Percent%20over%20Four%20Years&text=Four%20years%20later%2C%20on%20March.

[11] Kawachi, I., and B. P. Kennedy. 1997. “Health and Social Cohesion: Why Care about Income Inequality?” BMJ : British Medical Journal 314 (7086): 1037–40. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2126438/.

[12] Weir, Kirsten . 2022. “Closing the Health-Wealth Gap.” Apa.org. 2022. https://www.apa.org/monitor/2013/10/health-wealth#:~:text=Adults%20with%20lower%20socioeconomic%20status.

[13]Ton, Zeynep, and Sarah Kalloch. 2022. “PayPal and the Financial Wellness Initiative.” MIT Management Sloan School.

[14] Ton, Zeynep, and Sarah Kalloch. 2022. “PayPal and the Financial Wellness Initiative.” MIT Management Sloan School.