As promised in the last two issues, I am returning to the notion of Zakat (obligatory wealth-based giving/sharing for common good) with the Month of Ramadhan fast approaching. For many of us who fulfil our Zakat commitments, it is time to estimate, allocate and fulfil this important and foundational obligation which is one of the five pillars of our faith. This year Ramadhan will start on March 1st, and I am writing this piece so that it will arrive in time to share our collective understanding of what Zakat means and to what purpose(s) zakat should be used.

Our faith explicitly calls for two types of giving – simple charity (Sadaqat) and obligatory giving/sharing (Zakat). Zakat is based on wealth and savings. Once minimum wealth is achieved, it obligates one to give/share. The minimum is relatively small therefore almost all rich, middle class and rising middle class (other than poor) would meet the threshold and be obligated pay zakat. I started the broader topic of giving in the October issue , and talked about Sadaqah in particular in the November issue. In this issue I want to illuminate the meaning of Zakat.

Notice that I am categorizing Zakat as an act of giving/sharing, rather than charity. This is to differentiate it from Sadaqat. An example of charity (Sadaqat) would be to feed a hungry person. This act of charity (Sadakat) would provide short term or immediate relief to the person. Giving Zakat on the other hand would be an attempt at eliminating poverty so that a person was NEVER in jeopardy in the first place. Sadaqat is also more than monetary charity – any act of goodness is considered charity, whereas Zakat is a purely monetary obligation that should fund social and economic good for the larger society. I recognize that from a legal perspective and in light of IRS 501c(3) categorization, most donations (whether Sadaqah or Zakat) is considered charity in USA but that does not preclude us from making a distinction on the purpose these two categories should be directed.

Zakat comes from the root word ز ك و (jay kaf waw) implying purity and increase. In other words, the only way to achieve real growth in wealth is to purify it by giving to the common good. Sadaqat on the other hand, provides for the individual. Although, Sadaqat can also be for the common good when its purpose is augmenting Zakat. This is especially so as there is no limit on how much one can and should donate with Sadaqat. The challenge I see in our community is that we have turned Zakat into charitable giving, rather than making Zakat an annual source of strategic investment in education, economic wellbeing, empowerment and advancing truth and justice in society.

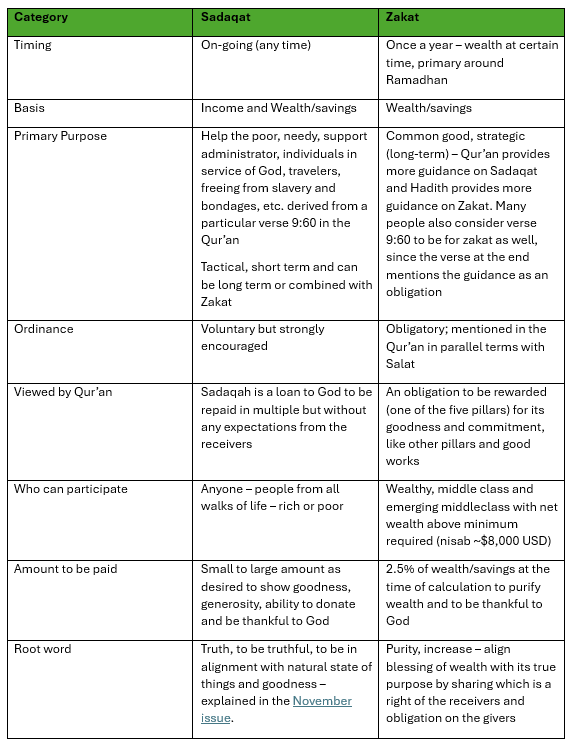

The table below gives a brief comparative aspect of Sadaqat vs. Zakat.

As you think about Zakat this year, before this upcoming Ramadhan, I would encourage all of us to rethink the purpose of Zakat and how we allocate our Zakat giving. Clarify the distinction that you are making between your Sadaqah and your Zakat. American Muslims have committed significant resources in the last 40 year to build Mosques and Community centers to serve the immediate need of our growing communities. By some estimate we have upward of 3000 mosques in the country now and at an average cost of $2M, this represents a $6B investment over the last 40 years. At an average operating expense of modest $75K per month per center, this also represents an on-going commitment to give $225M a year to operate these facilities and conduct community related activities. From the generational perspective, these community centers cater to children between K to 12 grades through Sunday schools and other community-based education and programs. College students who are at a critical juncture in deciding which profession to pursue, and many have financial needs as a top concern. To build the Muslim community for the future, we need to focus more on college students, as they will have the biggest impact for the community from a personal as well as community perspective. This is where our needs and focus should be on.

MyLLife is committed to encourage college students to explore public service as a career option by seeking appropriate majors for study, such as Law, public policy, economics, business, media, among others and to seek summer internships at public and non-profit organizations in order to gain real life experience and to be inspirated to pursue such careers after graduation. These students would be our brain trust and champion policies to advance truth and justice in society. The MyLLife Scholars program has been funding such internships since 2022 and has become a national program with applications being received from universities and colleges coast to coast. In parallel we have also launched an Economic and Social Justice Program (ESJP) to train and encourage college students to do impactful research to advance truth and justice (both economic and social) in society. We have engaged research fellows from undergraduate, graduate, JD, Ph.D. programs to challenge existing economic, financial and social norms from public policy perspectives to inform, analyze and challenge.

We ask that you explore these two core programs and consider allocating a meaningful portion of your Zakat for 2025 to such programs at MyLLife and other organizations as you see appropriate. We would love to hear your thoughts and guidance on our current work and future priorities.