Defining the Living Wage

The concept of a "living wage" is centered on the income necessary for individuals and families to meet their basic needs, such as housing, food, healthcare, and transportation, without relying on others or government assistance. Unlike the minimum wage, which is often set arbitrarily and can fall short of covering basic living expenses, the living wage is calculated based on the actual costs of living in a specific region.

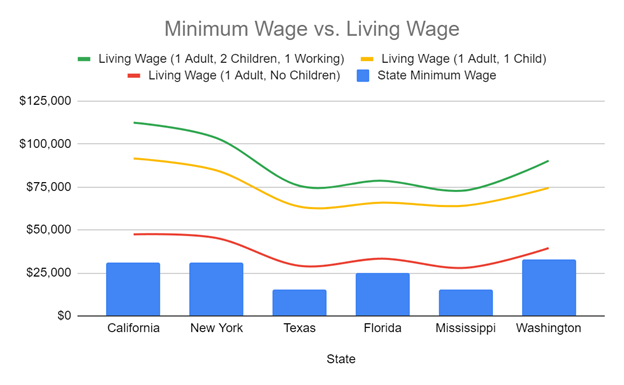

Living Wage by Household Type:

(Source: MIT Living Wage Calculator)

Living Wage vs. Minimum Wage

To understand the gap between what people needs to live and what they are often paid, it’s crucial to compare the living wage with the statutory minimum wage. The federal minimum wage in the United States is currently set at $7.25 per hour, though many states have higher minimum wages. However, even these higher minimum wages often fall short of the living wage needed to meet basic needs. Looking at the graph above, it shows that in all cases across states shown the minimum wages fall short of Living Wages for all family sizes. This highlights the challenges with Minimum Wage which is being argued in the House and the Senate but to no avail. Even a small increment will not address the gaping hole in income inequality and dire economic condition of the majority of American, majority of whom are gainfully employed but paid low wage that makes meaningful economic and consequently social life very difficult.

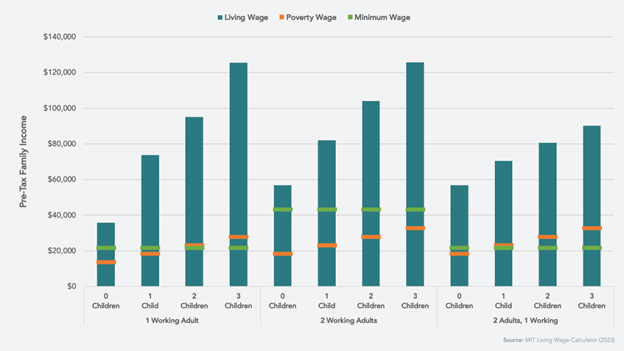

In the graph below we compare minimum wage to poverty wage, knowing well that current prevailing wages are woefully inadequate, with minimum wages, the following scenarios become evident:

- A single income earner with no or one children are the only household that can stay above poverty level, while, say a single mother with 2 or more children is in constant poverty

- Whereas, a married or two adult family the situation is little better but not by much, given that the second adult can help reduce child care and other expenses, factoring in the additional expense of a second adult

- In America today a family with two working adults is the only household that can stay above poverty level with minimum wage. It is no longer an option for the majority of American to have only one spouse work and support a family.

Pre-Tax Family Income: Comparing Living, Poverty, and Minimum Wage

(Source: MIT Living Wage Calculator)

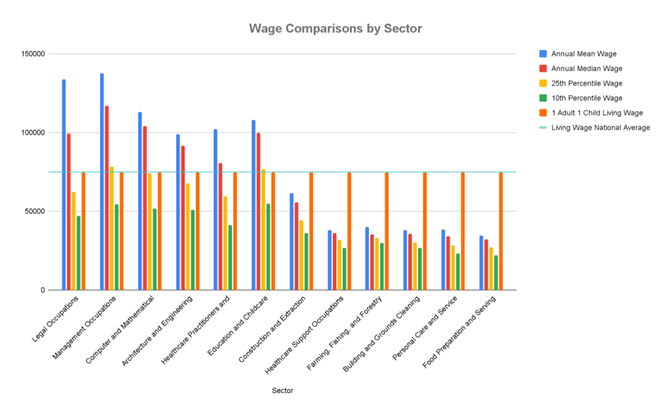

Wage Disparities: High and Low Contrasts

Pay disparities across various wage sectors reveal stark differences in how compensation is distributed. High-skill sectors like management, legal, and computer-related occupations offer wages that exceed the living wage in all states. For instance, management occupations have a median wage of $126,480, which is more than double the living wage even in the most expensive states. That is good news and should be so because these are college educated professionals paid well by our industrial complex. But the majority of employees in the non-managerial categories are predominantly “low wage” category that falls woefully short of living wages and also poverty wages.

Employee Sector Analysis:

- High-Wage Sectors: These include management, legal, and healthcare practitioners, where wages are significantly above the living wage. For example, legal occupations have a median wage of $126,930, reflecting the specialized skills and education required.

- Low-Wage Sectors: In contrast, sectors such as food preparation, personal care, and building maintenance often have median wages below the living wage. Food preparation occupations, with a median wage of $29,450, struggle to meet living wage requirements even in states with lower costs of living.

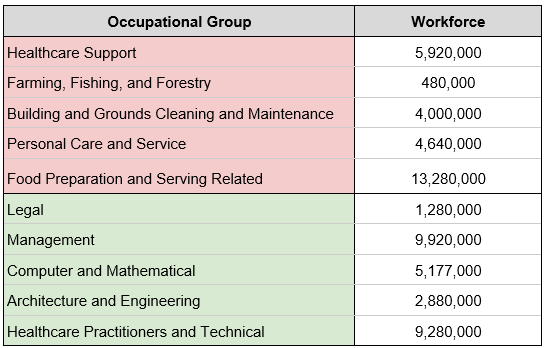

Workforce by Occupational Group:

The table reveals a clear divide between the lowest-paid and highest-paid sectors, marked by the red and green shading. Sectors like food service, personal care, and healthcare support are typically lower-wage fields, despite the essential nature of their work. Workers in lower-wage occupational group often struggle with financial insecurity, which affects not only their quality of life but also their ability to contribute to the economy through consumer spending. Moreover, this wage gap can deepen social inequality, perpetuating cycles of poverty and limiting upward mobility for those in low-paying roles. It also raises questions about how society values different types of labor, particularly in sectors critical to everyday life but consistently underpaid. This highlights the significant portion of the workforce that is vulnerable to financial instability.

Corporate America's Role in Wage Disparities

In analyzing wage disparities within corporate America, it is critical to address not only the differences in compensation between educational levels but also the undervaluation of essential work. While it is reasonable that individuals with advanced degrees and specialized skills command higher wages, the issue lies in the insufficient compensation for workers in lower-wage categories who perform indispensable tasks. These roles—often filled by individuals with a GED or high school diploma—form the backbone of many industries, yet their wages frequently fall short of the living wage.

This imbalance highlights a broader structural issue: the labor performed by those in low-wage occupations is essential, yet the compensation does not reflect the societal value of their contributions. The workforce in these roles provides services and support that are critical to both businesses and communities, often tasks that individuals with higher education would not perform. Therefore, the focus should not solely be on justifying higher pay for those with formal education, but rather on ensuring that all workers, regardless of educational background, are compensated at a level that allows for financial stability and economic mobility. Corporate America's role in addressing this disparity is crucial, as equitable wages are a key factor in reducing income inequality and fostering a more inclusive economy.

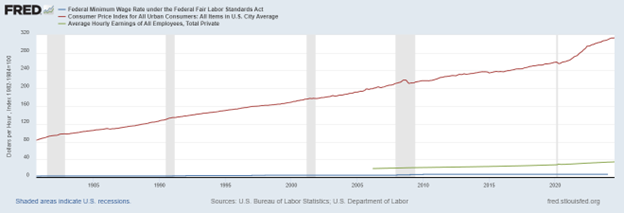

Despite the Consumer Price Index (CPI) rising by over 50% since 2009, reflecting significant increases in the cost of living, the federal minimum wage in the U.S. has remained stagnant at $7.25 per hour during the same period. This mismatch between rising prices and stagnant wages has led to a substantial decline in purchasing power for millions of workers, making it increasingly difficult for them to afford necessities such as housing, food, and healthcare. While inflation drives up costs, wages have failed to keep pace, deepening financial strain on those earning the least.

Addressing the Wage Gap

The wage gap between different sectors and the gap between minimum wage and living wage requirements underscore the need for a more equitable distribution of income. While it’s critical to acknowledge the complexities of corporate decision-making, it is equally important to recognize that ensuring fair wages for all workers is not just an ethical imperative but also a practical one that benefits the broader economy.

By closing these gaps and ensuring that all workers earn a living wage, we can foster a more inclusive economy that supports the well-being of all citizens, regardless of their occupation or educational background.

Up Next…

In the coming series, we will delve deeper into the micro and even more micro perspectives on this critical issue. We'll examine how wage policies affect small businesses, local economies, and individual well-being. We'll also look at the stories behind the statistics, bringing to light the personal experiences of those who live on the edge of financial security.

This ongoing investigation will aim to provide a holistic view of what it truly means to earn a living wage, and the ripple effects it has on society at every level. Stay tuned as we continue to unpack this vital topic, shedding light on the pathways to achieving a more equitable economic future for all.

Sources:

FRED Economic Data:

- Federal Reserve Bank of St. Louis. "Consumer Price Index for All Urban Consumers: All Items." Accessed August 27, 2024. https://fred.stlouisfed.org/series/CPIAUCSL

- Federal Reserve Bank of St. Louis. "Federal Minimum Wage for the United States." Accessed August 27, 2024. https://fred.stlouisfed.org/series/STTMINWGUS

Regional Cost of Living Analysis:

- U.S. Bureau of Economic Analysis. "Regional Price Parities by State and Metro Area." Accessed August 27, 2024. https://www.bea.gov/data/prices-inflation/regional-price-parities-state-and-metro-area

Housing Costs:

- Federal Reserve Bank of St. Louis. "Median Asking Rent for the United States." Accessed August 27, 2024. https://fred.stlouisfed.org/series/ASTHMAUS

- Joint Center for Housing Studies of Harvard University. "The State of the Nation’s Housing 2024." Accessed August 27, 2024. https://www.jchs.harvard.edu/state-nations-housing

Healthcare Costs:

- Centers for Medicare & Medicaid Services. "National Health Expenditure Data." Accessed August 27, 2024. https://www.cms.gov/research-statistics-data-and-systems/statistics-trends-and-reports/nationalhealthexpenddata

- Federal Reserve Bank of St. Louis. "Personal Consumption Expenditures: Services: Health Care." Accessed August 27, 2024. https://fred.stlouisfed.org/series/DHLCRGD3AQ086SBEA

Educational Costs:

- National Center for Education Statistics. "Tuition Costs of Colleges and Universities." Accessed August 27, 2024. https://nces.ed.gov/fastfacts/display.asp?id=76

- Federal Reserve Bank of St. Louis. "Consumer Price Index for All Urban Consumers: College Tuition and Fees." Accessed August 27, 2024. https://fred.stlouisfed.org/series/CUUR0000SEEB01

Poverty Rate and Wage Growth:

- U.S. Census Bureau. "Income and Poverty in the United States: 2023." Accessed August 27, 2024. https://www.census.gov/library/publications/2024/demo/p60-276.html

- Economic Policy Institute. "Wage Stagnation in Nine Charts." Accessed August 27, 2024. https://www.epi.org/publication/charting-wage-stagnation/

- Massachusetts Institute of Technology. "Living Wage Calculator." Accessed August 27, 2024. https://livingwage.mit.edu/

Essential Goods Inflation:

- Federal Reserve Bank of St. Louis. "Consumer Price Index for All Urban Consumers: Food." Accessed August 27, 2024. https://fred.stlouisfed.org/series/CUUR0000SAF1

- Federal Reserve Bank of St. Louis. "Consumer Price Index for All Urban Consumers: Energy." Accessed August 27, 2024. https://fred.stlouisfed.org/series/CUUR0000SA0E

Bureau of Labor and Statistics: